Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Rank: Elder Joined: 6/2/2008 Posts: 1,438

|

The drop in prices is certainly welcome. It gives room for share prices to experience considerable increases down the line. In my view, certain sections of our market remain cheap on PE, DY basis with good future prospects and this will attract buyers sooner rather than later. The tapering talk has jolted most emerging and frontier markets and as usual the NSE lags most international markets. Note that the former are already beginning to recover from the battering that they had experienced in the last few sessions. I guess the talk of the reintroduction of Capital Gains Tax has spooked our markets further. I am however betting that this slide cannot continue for too long and I have my money ready to buy into counters such as KCB and Equity Bank. @hisah, where does TA indicate to be the support levels for KCB, Equity and Safaricom? hisah wrote:FTSE NSE 15 & 25 indices are 7% plus week on week i.e. last monday to today. Torpedo selling

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

@guru - gaps get filled. Remember that...[/quote]    Respect to Hisah

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Metasploit wrote:Like it!!Got some kenya re today at 15.50!!

I @15.20. From keshoz we know how smart that was.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Market decline on low volumes. Speaks volume

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

Cde Monomotapa wrote:Metasploit wrote:Like it!!Got some kenya re today at 15.50!!

I @15.20. From keshoz we know how smart that was.  RSI for index below 30.For most shares RSI is between 30-37. Last bottom for the index is 4763.If it the floor isnt at 4760 i will be scared. How low can it get ? Will waTCH the Market tomorrow and Wednesday then Make a decision for EQUITY,KCB,Kenya RE.Even HFCK has started feeling the heat

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Metasploit wrote:Cde Monomotapa wrote:Metasploit wrote:Like it!!Got some kenya re today at 15.50!!

I @15.20. From keshoz we know how smart that was.  RSI for index below 30.For most shares RSI is between 30-37. Last bottom for the index is 4763.If it the floor isnt at 4760 i will be scared. How low can it get ? Will waTCH the Market tomorrow and Wednesday then Make a decision for EQUITY,KCB,Kenya RE.Even HFCK has started feeling the heat Sure. From various I got today I'm benchmarking -20% b4 further deployment. Let's see.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

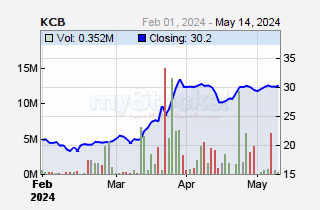

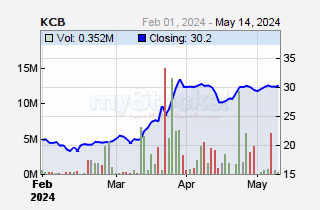

mwanahisa wrote:The drop in prices is certainly welcome. It gives room for share prices to experience considerable increases down the line. In my view, certain sections of our market remain cheap on PE, DY basis with good future prospects and this will attract buyers sooner rather than later. The tapering talk has jolted most emerging and frontier markets and as usual the NSE lags most international markets. Note that the former are already beginning to recover from the battering that they had experienced in the last few sessions. I guess the talk of the reintroduction of Capital Gains Tax has spooked our markets further. I am however betting that this slide cannot continue for too long and I have my money ready to buy into counters such as KCB and Equity Bank. @hisah, where does TA indicate to be the support levels for KCB, Equity and Safaricom? hisah wrote:FTSE NSE 15 & 25 indices are 7% plus week on week i.e. last monday to today. Torpedo selling  KCB - Target 35 then 33

Equity - Target 30 then 28 (got in here)

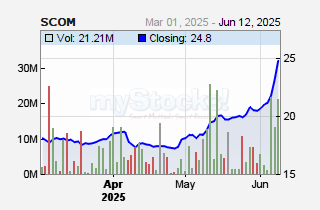

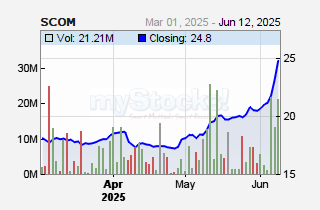

Safcom - Target 6.50 then 6

The more mpesa bank sags the lower NSE20 will sag.

KQ has a lot of fans smile by holding 10 despite the horrible news. Remember KK before celebrating. A supply test is definitely coming, don't be suckered...

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

hisah wrote:FTSE NSE 15 & 25 indices are 7% plus week on week i.e. last monday to today. Torpedo selling  [/quote] KCB - Target 35 then 33

Equity - Target 30 then 28 (got in here)

Safcom - Target 6.50 then 6

The more mpesa bank sags the lower NSE20 will sag.

KQ has a lot of fans smile by holding 10 despite the horrible news. Remember KK before celebrating. A supply test is definitely coming, don't be suckered...

[/quote] This implies the floor to be slightly below 4500!!!

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Who's selling? "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

Capital Gains Tax!!!! Until we know the unknown on this CGT thing expect nothing but insane volatility!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

Yes,bad gvt policies can make you poor at a glance. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Dow sitting pretty in positive territory at some point hitting a session high of +191points on easing expectations. Hope Ben's watching  Madness may just make a comeback to the NSE tomoro! @SufficientlyP

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

Sufficiently Philanga....thropic wrote:Dow sitting pretty in positive territory at some point hitting a session high of +191points on easing expectations. Hope Ben's watching  Madness may just make a comeback to the NSE tomoro! Atleast there's one person bullish on the US market on this forum  There's no way Bernanke is ending QE anytime soon, if he does we are completely screwed

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

Safcom Demand picking up! Today might be the last day of the slaughter

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

Nabwire wrote:Sufficiently Philanga....thropic wrote:Dow sitting pretty in positive territory at some point hitting a session high of +191points on easing expectations. Hope Ben's watching  Madness may just make a comeback to the NSE tomoro! Atleast there's one person bullish on the US market on this forum  There's no way Bernanke is ending QE anytime soon, if he does we are completely screwed The longer he stays the worse it will be when he or the next person does.

|

|

|

Rank: Member Joined: 2/13/2011 Posts: 284 Location: Nairobi

|

KPLC looking very attractive, i feel lyk dialing my broker

|

|

|

Rank: Veteran Joined: 11/11/2006 Posts: 972 Location: Home

|

hisah wrote:So we end the week with NSE20 breaking out of the rising wedge downwards with huge volume on the week that the budget was read. That break will definitely push down prices for a while. Same selloff strength is noted on all foreign based KE indices - MSCI KE and the FTSE NSE 15/25.

The budget offered mixed signals, but that VAT bill if implemented as per IMF prayers, inflation will strike back.

Overall the correction that was on the cards since April 2013 is very welcome. Above 5000 the market was priced ahead of itself and soberness has to run the show after the election euphoria has gone. Tbills continue falling with 91 days now below 6% as per this week's auction results i.e. 5.424%. Market correcting, tbills falling and again that divergence scenario pops up. But with that current account deficit I don't expect Tbills to fall too far from here.

Remember, low tbill rates = equity market becomes more attractive to park your cash there. So enjoy the discounts on quality stocks as they come. Now T-bills falling, stocks falling, weird market this one.

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

holycow wrote:hisah wrote:So we end the week with NSE20 breaking out of the rising wedge downwards with huge volume on the week that the budget was read. That break will definitely push down prices for a while. Same selloff strength is noted on all foreign based KE indices - MSCI KE and the FTSE NSE 15/25.

The budget offered mixed signals, but that VAT bill if implemented as per IMF prayers, inflation will strike back.

Overall the correction that was on the cards since April 2013 is very welcome. Above 5000 the market was priced ahead of itself and soberness has to run the show after the election euphoria has gone. Tbills continue falling with 91 days now below 6% as per this week's auction results i.e. 5.424%. Market correcting, tbills falling and again that divergence scenario pops up. But with that current account deficit I don't expect Tbills to fall too far from here.

Remember, low tbill rates = equity market becomes more attractive to park your cash there. So enjoy the discounts on quality stocks as they come. Now T-bills falling, stocks falling, weird market this one. T-bills falling bad for banks and interest rates are not following suit bad for stocks.CBK and banks are fighting it out.At least thats how I see it.

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

NSE wrote:Turnover rose to Kes.495M from the previous session’s Kes.309M, the number of shares traded stood at 19M against 32M posted yesterday.

The NSE 20 Share Index was down 1.27% to stand at 4701.22 points.

All Share Index (NASI) shed 0.85 points to stand at 118.78.

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|