Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

youcan'tstopusnow wrote:Cde Monomotapa wrote:youcan'tstopusnow wrote:The UK government is expected to apologise to those tortured during the Mau Mau uprising in Kenya in the 1950s, the BBC understands. Compensation for the victims is also expected to be announced. http://m.bbc.co.uk/news/uk-22790037

Huh..good lawyers will get a settlement. Can you picture a full trial & a precedent? *whistles* That'll open a floodgate to ALL* former colonies   Every man for himself. Afrika hoyee!   Apologies bro, got tenses wrong. I meant 'would have opened...'. Thus, this is a UK-KE duo score...

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

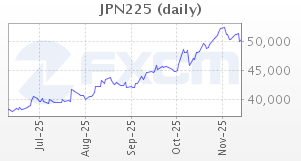

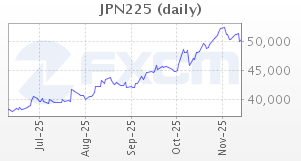

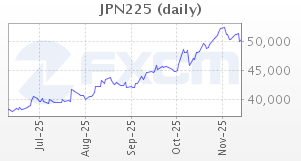

hisah wrote: Nikkei today slid by 1000+ points! Last time that happened was during that mega quake in March 2011. It is getting cranky... Japan’s Topix index slides 7%, as financial companies plunge amid rising bond yields - http://www.livemint.com/...in-afternoon-trade.html

2 weeks later nikkei is 3000pts plus down.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

karanjakinuthia wrote:@Murchr. Capital is fleeing the clutches of the tax authorities in the Western World. Capital is fleeing banks in the Western World after the adoption of the Cyprus "bail-in" model. Capital is fleeing investment banks/banksters/untouchables in the Western World. Behold, London has taken over the mantle of Financial Capital of the World from the corrupt New York: https://en.wikipedia.org/wiki/Financial_centre

If the U.S. or U.K. authorities wish to get a hold of the identities of account holders, they just need to threaten to kick Kenya out of the S.W.I.F.T. system. murchr wrote:Secrecy Savannah: Is Kenya being Shaped into Africa’s Flagship Tax Haven?If anyone doubted the sheer scale of corporate power and the importance of tax havens to it, they had the unedifying spectacle of Tim Cook, CEO of Apple, to enlighten them last month. In already infamous evidence to a US Senate Committee, Cook demonstrated that the international tax system is broken and big corporations are the last people to fix it. He said outright that he won’t consider repatriating the staggering $100 billion they have hoarded offshore if it means paying standard US corporation tax. .... This time, the Corporation of the City of London is trying to expand its shadow economy into Kenya. The City of London and its ‘independent’ lobbying arm, CityUK, have been conducting high-level negotiations to help the country develop as an ‘International Financial Centre’. This may sound like a benign and even worthwhile activity. Kenya, after all, must develop, and being an International Financial Centre sounds like a good way of going about it. But what does being an “International Financial Centre” actually mean? Very interesting.

London threatened by plans to move Libor regulation to Paris - http://www.telegraph.co....egulation-to-Paris.html

Quote:Brussels has drawn up proposals to formalise regulation of a range of pricing structures, from the Libor inter-bank lending rate to benchmarks for oil and gold. Under the plan, Libor would come under the supervision of the European Securities and Markets Authority, which is based in Paris.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

The sky is not falling contrary to popular belief. Hedge fund managers & major investors are busy partying it up in the Hamptons following the recent rally. Its common knowledge that May & June are slow trading months on Wall Street, there is the saying that sell in May and go away. Basically its interns and juniors working right now, so I wouldn't use market performance at this time as a basis.

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

Jamie Dimon says investors should expect volatility in the coming weeks. It should be a rough ride ahead coz the Fed's QE is set to expire early next year as Bernanke retires as Fed chairman. Its gonna be tough without Bernanke, that's a scary thought coz the next Fed chairman will make or break the market. Obama better not disappoint us by hiring a dunzo, I wonder who is on his short list, I would guess Larry Summers.

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

When markets react negatively to low unemployment and positively to low production,you've got a problem.

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

symbols wrote:When markets react negatively to low unemployment and positively to low production,you've got a problem. I'm not sure what you mean by this, the market was up because of the perception of the economy & housing picking up, but after Bernanke spoke, he did not succinctly say that QE will be extended, so there's speculation that they are winding it up. The market does not like uncertainty thus the volatility

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

Nabwire wrote:symbols wrote:When markets react negatively to low unemployment and positively to low production,you've got a problem. I'm not sure what you mean by this, the market was up because of the perception of the economy & housing picking up, but after Bernanke spoke, he did not succinctly say that QE will be extended, so there's speculation that they are winding it up. The market does not like uncertainty thus the volatility How I see it,the market wants a clear outlook but Bernanke was suggesting things might change if the economy is doing well.So high unemployment and low production is good for QE and good for rallies.Problem is,more debt,high unemployment and low production  How do you see it?

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

Oh nimekuelewa! As an investor I selfishly only care about increasing my bank account, so if Bernanke extends QE and it positively helps my stocks, I'm ok with that. I don't tend to worry about the bigger picture coz everything eventually falls into place. Like this article I was reading about how Bernanke is buying assets in banks hoping that with the cash the banks will have, it will spur lending thus stimulate the economy. I personally think Bernanke is a genius, 5 years ago people were against him but now the economy is on pace to recovery coz of him. Lets just hope the next person has the same strategy.

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

By the way all that he said was he was rolling out open ended QE, my understanding of that is he will jump in and act if the economy needs stimulus, but if the economy is doing well, there will be no need for interfering thus no QE. That sounds like a contingency plan to me, which is great!

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

I'm bearish on his strategy.

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

Big Brother is watching. "The National Security Agency and the FBI are tapping directly into the central servers of nine leading U.S. Internet companies, extracting audio and video chats, photographs, e-mails, documents, and connection logs that enable analysts to track foreign targets, according to a top-secret document obtained by The Washington Post.... Equally unusual is the way the NSA extracts what it wants, according to the document: “Collection directly from the servers of these U.S. Service Providers: Microsoft, Yahoo, Google, Facebook, PalTalk, AOL, Skype, YouTube, Apple.” Read more: http://www.washingtonpos...d970ccb04497_story.html

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

When you add 3.14 (Pi) years to the beginning of the Greek Debt Crisis on 16th of April, 2010, you arrive at 5th of June, 2013. "The IMF on Wednesday admitted to significant failures in the first Greek rescue that forced a second, larger bailout and left the country in a deep recession. However, the global lender placed much of the blame on its Greek and European partners, saying they were unprepared for the crisis and the harsh choices — including a deep debt restructuring — that may have made the first bailout work better..." Read more: http://www.taipeitimes.c...s/2013/06/07/2003564147

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

The Aristotle Cycle of Government points out that the United States is in the Oligarchy stage, descending into a Tyranny after which it will reset back to Democracy. In between the Oligarchy/Tyrannical stage and rebirth of democracy is revolution. The week of 23rd September, 2013 may be an important pivot point. "...that the first governments were generally monarchies; because it was difficult to find a number of persons eminently virtuous, more particularly as the world was then divided into small communities; besides, kings were appointed in return for the benefits they had conferred on mankind; but such actions are peculiar to good men: but when many persons equal in virtue appeared at the time, they brooked not a superiority, but sought after an equality and established a free state; but after this, when they degenerated, they made a property of the public; which probably gave rise to oligarchies; for they made wealth meritorious, and the honours of government were reserved for the rich: and these afterwards turned to tyrannies and these in their turn gave rise to democracies; for the power of the tyrants continually decreasing, on account of their rapacious avarice, the people grew powerful enough to frame and establish democracies: and as cities after that happened to increase, probably it was not easy for them to be under any other government than a democracy."- A Treatise on Government by Aristotle: Part 3 Chapter 15 The NDAA's historic assault on American liberty http://www.guardian.co.u...ssault-american-liberty

Police allowed to track cell phones in US without court warrants http://rt.com/usa/police-track-cell-court-979/

1.6 Billion Rounds Of Ammo For Homeland Security? It's Time For A National Conversation http://www.forbes.com/si...-national-conversation/

Drones are taking to the skies in the U.S.: http://articles.latimes....omestic-drones-20130216

Machine gun fire from military helicopters flying over downtown Miami Fl. http://www.youtube.com/w...feature=player_embedded

Army drill scares residents on Houston's south side http://abclocal.go.com/k...ws/local&id=8971311

‘Obama Truth Team’ Orders GoDaddy To Shut Down Website http://www.infowars.com/...y-to-shut-down-website/

DHS emergency power extended, including control of private telecom systems http://www.washingtontim...-including-control-of-/

TSA to install molecular body scanners http://www.youtube.com/w...feature=player_embedded

Social Security Administration Requests 174,000 Bullets http://www.huffingtonpos...-bullets_n_1797069.html

The Internal Revenue Service (IRS) intends to purchase sixty Remington Model 870 Police RAMAC #24587 12 gauge pump-action shotguns for the Criminal Investigation Division https://www.fbo.gov/inde...p;cck=1&au=&ck=

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

karanjakinuthia wrote:The Aristotle Cycle of Government points out that the United States is in the Oligarchy stage, descending into a Tyranny after which it will reset back to Democracy. In between the Oligarchy/Tyrannical stage and rebirth of democracy is revolution. The week of 23rd September, 2013 may be an important pivot point. "...that the first governments were generally monarchies; because it was difficult to find a number of persons eminently virtuous, more particularly as the world was then divided into small communities; besides, kings were appointed in return for the benefits they had conferred on mankind; but such actions are peculiar to good men: but when many persons equal in virtue appeared at the time, they brooked not a superiority, but sought after an equality and established a free state; but after this, when they degenerated, they made a property of the public; which probably gave rise to oligarchies; for they made wealth meritorious, and the honours of government were reserved for the rich: and these afterwards turned to tyrannies and these in their turn gave rise to democracies; for the power of the tyrants continually decreasing, on account of their rapacious avarice, the people grew powerful enough to frame and establish democracies: and as cities after that happened to increase, probably it was not easy for them to be under any other government than a democracy."- A Treatise on Government by Aristotle: Part 3 Chapter 15 The NDAA's historic assault on American liberty http://www.guardian.co.u...ssault-american-liberty

Police allowed to track cell phones in US without court warrants http://rt.com/usa/police-track-cell-court-979/

1.6 Billion Rounds Of Ammo For Homeland Security? It's Time For A National Conversation http://www.forbes.com/si...-national-conversation/

Drones are taking to the skies in the U.S.: http://articles.latimes....omestic-drones-20130216

Machine gun fire from military helicopters flying over downtown Miami Fl. http://www.youtube.com/w...feature=player_embedded

Army drill scares residents on Houston's south side http://abclocal.go.com/k...ws/local&id=8971311

‘Obama Truth Team’ Orders GoDaddy To Shut Down Website http://www.infowars.com/...y-to-shut-down-website/

DHS emergency power extended, including control of private telecom systems http://www.washingtontim...-including-control-of-/

TSA to install molecular body scanners http://www.youtube.com/w...feature=player_embedded

Social Security Administration Requests 174,000 Bullets http://www.huffingtonpos...-bullets_n_1797069.html

The Internal Revenue Service (IRS) intends to purchase sixty Remington Model 870 Police RAMAC #24587 12 gauge pump-action shotguns for the Criminal Investigation Division https://www.fbo.gov/inde...p;cck=1&au=&ck=  Social decay is setting in and the internet is the new Socrates challenging the power structures.The insistence of the US government on cyber security has exposed their hypocrisy.Targeting China for all the hacks and using the Die Hard 4 theme of disabling power grids and other infrastructure to get their way.On the other hand they orchestrated Stuxnet and other viruses targeting the Middle East which if it was an attack on them would be nothing short of war.It's basically becoming the nuclear weapons issue again.It's all good when they have them but no else should.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:hisah wrote: Nikkei today slid by 1000+ points! Last time that happened was during that mega quake in March 2011. It is getting cranky... Japan’s Topix index slides 7%, as financial companies plunge amid rising bond yields - http://www.livemint.com/...in-afternoon-trade.html

2 weeks later nikkei is 3000pts plus down. Just like the jap bond market gave a nice signal to short the nikkei, the same is happening to US fin market. Soon this interest rate spike cocktail will go global. Interest rate spike = equity selloff. KE investors have a 2011 fresh reminder...

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

hisah wrote:hisah wrote:hisah wrote: Nikkei today slid by 1000+ points! Last time that happened was during that mega quake in March 2011. It is getting cranky... Japan’s Topix index slides 7%, as financial companies plunge amid rising bond yields - http://www.livemint.com/...in-afternoon-trade.html

2 weeks later nikkei is 3000pts plus down. Just like the jap bond market gave a nice signal to short the nikkei, the same is happening to US fin market. Soon this interest rate spike cocktail will go global. Interest rate spike = equity selloff. KE investors have a 2011 fresh reminder...

Japan got me seriously interested in currency.I totally agree,the global interest rate situation is something that investors should be eying keenly. Portfolio Managers Are Asking Themselves One Question After Recent TradingQuote:From Richard Moroney: "If a mere one-half percentage point increase in bond yields can have so much impact — halting the broad stock market’s advance and triggering considerable tumult in high-yield stocks and aggressive bonds — what’s going to happen when yields return to more normalized levels?

There is so much bearish news I don't know what to think.

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

China Export Growth Plummets Amid Fake-Shipment CrackdownQuote:China’s trade, inflation and lending data for May all trailed estimates, signaling weaker global and domestic demand that will test the nation’s leaders’ resolve to forgo short-term stimulus for slower, more-sustainable growth. Aging Nations Like Low Prices Over High Income: Cutting ResearchQuote:Since aging demographics will now start to feature more prominently in the outlook for many major developed and developing countries this is clearly of some significance for how inflation might evolve

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|