Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

mwekez@ji wrote:guru267 wrote:I hear one of the dyer and Blair servers crashed so no online trading!  Looks like we will have low volumes today given D&Bs market share! >What D&Bs market share? >Whats the frequency of their market research reports (daily, weekly, on material announcements) >Whats the quality of the market research reports? @Mwekez@ji I actually get daily reports... like clockwork! Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

kazee wrote:guru267 wrote:I hear one of the dyer and Blair servers crashed so no online trading!  Looks like we will have low volumes today given D&Bs market share! Only about 100m worth has traded and it is around 11:30. ION, i am setting my EABL exit at 520. Let's how long it takes to get there! Finally back online... over to the money!  Volumes should increase in the afternoon Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

guru267 wrote:mwekez@ji wrote:guru267 wrote:I hear one of the dyer and Blair servers crashed so no online trading!  Looks like we will have low volumes today given D&Bs market share! >What D&Bs market share? >Whats the frequency of their market research reports (daily, weekly, on material announcements) >Whats the quality of the market research reports? @Mwekez@ji I actually get daily reports... like clockwork! Tx

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

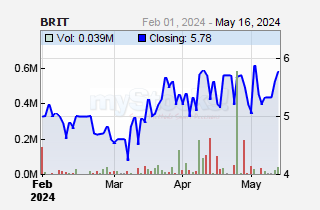

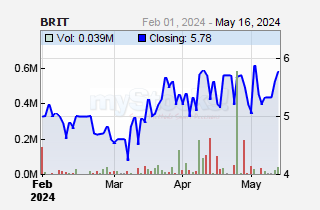

Metasploit wrote:hisah wrote:Britank's recovery is similar to that of Coop bank post listing hard selloff & rally. The listing price (9) is still a barrier until 9.50 is broken with volume spike. That 2nd upleg will be furious. For now insurance counters will consolidate till H1 results are availed. That upleg will sustain till year end. This is still the insurance counters year. Banks had their's last year. Now I wait for mpesa bank results. Let's see if the good news will sustain the buy pressure since Nov 2012. I never expected this elephant to clock above 5.80 in 2013 and I can only watch mr market crazy move. Now that NSE20 is in a reversal mood that is expected to spread into May, any heavy selling (10 - 15%) on mpesa bank post results (if EPS < 0.40) will make the index to sag more. For those still expecting 5400 to print this year, mpesa bank, eabl, member, bbk, coop, scbk, arm & bamburi need to rally at least 20% and sustain those levels. A big boost could also come from kk's recovery above 13. All these will need volume to spike on the bid side.  Interesting volume moves on Britank on an RSI less than 35. Mid morning 2.5 M shares traded by locals.At about 1.00 PM ,foreigners did like 3M shares.Same pattern of behavior like Uchumi,last week when it was trading at 17.8-18 and at an RSI of 31. 96,646,200 shares traded.

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

|

|

|

Rank: Veteran Joined: 3/26/2012 Posts: 985 Location: Dar es salaam,Tanzania

|

http://www.the-star.co.k...eadying-big-announcement

“The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.”

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Metasploit wrote:http://www.the-star.co.ke/news/article-121049/market-readying-big-announcement Great analysis by Mr. Rich My highlights Quote: Egypt, in my view, has yet to reach the denouement and a denouement it shall be. The Egyptian pound is trading at a record low and the blackmarket rate is way higher. The Egyptian stock market has eked out a +1.65% gain this year. Quote:South Africa is also seriously problematic. The Rand is at a four-year low and that in itself is a signal that money is hitting the exit button. And in my business, you follow the money because the money trail is always the most honest messenger. And the Africa money trail is informing me that investors are now more enamoured with the African middle rather than the gateways. Quote:Kenya could attain double-digit growth if it properly manages wealth from its newly discovered natural resources. I completely agree with Ragnar. Let me finish this piece by a quick sweep through the Nairobi Securities Exchange. Of course, last week, the big set piece event was the release of Safaricom's FY earnings. Safaricom raised the dividend pay-out +40.9% year on year and that of itself tells you everything you need to know. Safaricom has returned more than 100% over the last 12 months. Quote: I have followed the markets since I was a young boy, I cannot recall such a sequence. The money trail is confirming an imminent announcement and I can only speculate that it must be around a geographical expansion or an acquisition. The Securities Exchange entered a bull market in May 2012. I said that we would rally between 30%-35% after the election on a 'de-risking' of Kenya Inc. In the last two weeks, we have experienced 1/3rd of that prediction. @hisah, Mr Rich thinks like you....what say you about his article? "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

mwekez@ji wrote:guru267 wrote:I hear one of the dyer and Blair servers crashed so no online trading!  Looks like we will have low volumes today given D&Bs market share! >What D&Bs market share? Got data for year 2011:- 1. Kestrel – 22% 2. Rencap – 12% 3. CFC – 10% 4. AA – 10% 5. D&B – 8% 6. Sterling – 6% 7. SIB – 5% 8. Apex – 5% 9. Faida – 5% 10. NIC – 4% 11. Others – 13% Would like to see for 2012

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

mwekez@ji wrote:mwekez@ji wrote:guru267 wrote:I hear one of the dyer and Blair servers crashed so no online trading!  Looks like we will have low volumes today given D&Bs market share! >What D&Bs market share? Got data for year 2011:- 1. Kestrel – 22% 2. Rencap – 12% 3. CFC – 10% 4. AA – 10% 5. D&B – 8% 6. Sterling – 6% 7. SIB – 5% 8. Apex – 5% 9. Faida – 5% 10. NIC – 4% 11. Others – 13% Would like to see for 2012 This whole week, Mon to Wed, the D&B server has been having issues and the volume at the NSE has been low too..look at the volume in the afternoon when the server was back up!! that should tell u something "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Today afternoon was exceptional. Britam traded a whopping 101.307m shares which represents 0.535% of its shares worth 834.492m and represented 52.139% of the market turnover.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

mwekez@ji wrote:Today afternoon was exceptional. Britam traded a whopping 101.307m shares which represents 0.535% of its shares worth 834.492m and represented 52.139% of the market turnover. What about Monday morning? "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

@murchr, it would be best if you supported your hypothesis preferably with numbers. .... On matter of morning Vs afternoon, i can tell that afternoons are by and large more active coz both europeans and americans are in the market in the afternoons

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

mwekez@ji wrote:@murchr, it would be best if you supported your hypothesis preferably with numbers. .... On matter of morning Vs afternoon, i can tell that afternoons are by and large more active coz both europeans and americans are in the market in the afternoons I aint a broker so I wouldn't know the numbers per say, but if you look at the volumes on Monday then you'd draw a hypothesis. The Europeans and Americans trade thru our brokers ama? "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

murchr wrote:mwekez@ji wrote:@murchr, it would be best if you supported your hypothesis preferably with numbers. .... On matter of morning Vs afternoon, i can tell that afternoons are by and large more active coz both europeans and americans are in the market in the afternoons I aint a broker so I wouldn't know the numbers per say, but if you look at the volumes on Monday then you'd draw a hypothesis. The Europeans and Americans trade thru our brokers ama? Cool. D&B has a market share so when its system is down, market is affected. would however have wanted to know the market share they command and hence the extent of the impact ... Europeans & Americans do trade via our brokers. notice we are on different time zones. Our afternoon is Americans morning, their wake up time to start trading

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

mwekez@ji wrote:@murchr, it would be best if you supported your hypothesis preferably with numbers. .... On matter of morning Vs afternoon, i can tell that afternoons are by and large more active coz both europeans and americans are in the market in the afternoons @Mwekez@ji next time the server crashes ill inform you na tutaangalia volumes.. Sawa?? Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

murchr wrote:Metasploit wrote:http://www.the-star.co.ke/news/article-121049/market-readying-big-announcement Great analysis by Mr. Rich My highlights Quote: Egypt, in my view, has yet to reach the denouement and a denouement it shall be. The Egyptian pound is trading at a record low and the blackmarket rate is way higher. The Egyptian stock market has eked out a +1.65% gain this year. Quote:South Africa is also seriously problematic. The Rand is at a four-year low and that in itself is a signal that money is hitting the exit button. And in my business, you follow the money because the money trail is always the most honest messenger. And the Africa money trail is informing me that investors are now more enamoured with the African middle rather than the gateways. Quote:Kenya could attain double-digit growth if it properly manages wealth from its newly discovered natural resources. I completely agree with Ragnar. Let me finish this piece by a quick sweep through the Nairobi Securities Exchange. Of course, last week, the big set piece event was the release of Safaricom's FY earnings. Safaricom raised the dividend pay-out +40.9% year on year and that of itself tells you everything you need to know. Safaricom has returned more than 100% over the last 12 months. Quote: I have followed the markets since I was a young boy, I cannot recall such a sequence. The money trail is confirming an imminent announcement and I can only speculate that it must be around a geographical expansion or an acquisition. The Securities Exchange entered a bull market in May 2012. I said that we would rally between 30%-35% after the election on a 'de-risking' of Kenya Inc. In the last two weeks, we have experienced 1/3rd of that prediction. @hisah, Mr Rich thinks like you....what say you about his article? Interesting thoughts by Satchu. I concentrate more on SA than the north since it has the largest money trail in Africa. The rand has been acting up since last year even if JSE has ignored it. That reality will strike home at some point.

It makes sense to shift to EA if you look at hydrocarbon play as well as their econs still at infant stage. The issue is how to bring in the money without causing these small econs to overheat (inflating bubbles) badly due to that money flood. Thus the numerous mega infrastructure projects from power, transport and then metros or cities. The small nature of the EA econs plus the hydrocarbon play makes a very attractive cocktail for anyone chasing yields. SSA is now picking up faster than north or south africa. Money will always chase fatter yields. In short it's SSA turn to get fattened until that time when it cant grow fat at a fast rate. And that is a long way off and a decade multi econ boom is not far fetched. The new girl in town is being wooed by the west (after being ignored for a while) and now a new moneyed guy from the east. Let the best suitor win

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Metasploit wrote:Metasploit wrote:hisah wrote:Britank's recovery is similar to that of Coop bank post listing hard selloff & rally. The listing price (9) is still a barrier until 9.50 is broken with volume spike. That 2nd upleg will be furious. For now insurance counters will consolidate till H1 results are availed. That upleg will sustain till year end. This is still the insurance counters year. Banks had their's last year. Now I wait for mpesa bank results. Let's see if the good news will sustain the buy pressure since Nov 2012. I never expected this elephant to clock above 5.80 in 2013 and I can only watch mr market crazy move. Now that NSE20 is in a reversal mood that is expected to spread into May, any heavy selling (10 - 15%) on mpesa bank post results (if EPS < 0.40) will make the index to sag more. For those still expecting 5400 to print this year, mpesa bank, eabl, member, bbk, coop, scbk, arm & bamburi need to rally at least 20% and sustain those levels. A big boost could also come from kk's recovery above 13. All these will need volume to spike on the bid side.  Interesting volume moves on Britank on an RSI less than 35. Mid morning 2.5 M shares traded by locals.At about 1.00 PM ,foreigners did like 3M shares.Same pattern of behavior like Uchumi,last week when it was trading at 17.8-18 and at an RSI of 31. 96,646,200 shares traded. Britank traded 101M at close. Almost clocking 1B in turnover! Britank untanking...

This month some hefty volume has been coming in. ARM,CFC, KK, Britak, EABL, KCB, BAMB, Mpesa bank, member. Sizable volume like I had wished for when April flashed a reversal signal. This is good support and if the bid pressure keeps up, the melt up will be quite a show except if riding crappy stocks.

With the likes of JPM now present on the ground some announcement is coming soon... CFC's corporate yield feast is a tell tale that big bucks are shifting on the ground.

Btw did I read right that KCB is completing a marina complex at the coast? Fantastic. Some big bucks spinners are already in town. Condos & marinas are their games. Now waiting for gulf funds to check in heavily as the melt up continues.

For local enterpreneurs they need to think outside the box on how a moneyed wanjiku will behave. Mpesa bank is already front running this move.

Remember then a Mongolia happened. I'm already there in 2018...

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

guru267 wrote:mwekez@ji wrote:@murchr, it would be best if you supported your hypothesis preferably with numbers. .... On matter of morning Vs afternoon, i can tell that afternoons are by and large more active coz both europeans and americans are in the market in the afternoons @Mwekez@ji next time the server crashes ill inform you na tutaangalia volumes.. Sawa?? Sawaz ...

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

mwekez@ji wrote:guru267 wrote:mwekez@ji wrote:@murchr, it would be best if you supported your hypothesis preferably with numbers. .... On matter of morning Vs afternoon, i can tell that afternoons are by and large more active coz both europeans and americans are in the market in the afternoons @Mwekez@ji next time the server crashes ill inform you na tutaangalia volumes.. Sawa?? Sawaz ... @Mwekez@ji it also looks like we are down this morning though no officials communications from management! Check volumes Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

guru267 wrote:mwekez@ji wrote:guru267 wrote:mwekez@ji wrote:@murchr, it would be best if you supported your hypothesis preferably with numbers. .... On matter of morning Vs afternoon, i can tell that afternoons are by and large more active coz both europeans and americans are in the market in the afternoons @Mwekez@ji next time the server crashes ill inform you na tutaangalia volumes.. Sawa?? Sawaz ... @Mwekez@ji it also looks like we are down this morning though no officials communications from management! Check volumes Checking. Current Turnover, KES 39.83M - 10.20am

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

mwekez@ji wrote:guru267 wrote:mwekez@ji wrote:guru267 wrote:mwekez@ji wrote:@murchr, it would be best if you supported your hypothesis preferably with numbers. .... On matter of morning Vs afternoon, i can tell that afternoons are by and large more active coz both europeans and americans are in the market in the afternoons @Mwekez@ji next time the server crashes ill inform you na tutaangalia volumes.. Sawa?? Sawaz ... @Mwekez@ji it also looks like we are down this morning though no officials communications from management! Check volumes Checking. Current Turnover, KES 39.83M - 10.20am ...KES 50.54M, 10.53am

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|