Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Cde Monomotapa wrote:MPC postpone to Tuesday, 7th. Better be cooking something good;-) GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

youcan'tstopusnow wrote:Cde Monomotapa wrote:MPC postpone to Tuesday, 7th. Better be cooking something good;-) Jumper cables

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Cde Monomotapa wrote:youcan'tstopusnow wrote:Cde Monomotapa wrote:MPC postpone to Tuesday, 7th. Better be cooking something good;-) Jumper cables  Out of 13 analysts and traders polled by Reuters 10 expected policymakers to keep the central bank rate at 9.50 per cent for the second straight meeting, held every two months, citing an upside risk to inflation due to higher food prices. "The potential upside in headline inflation in Q3 may also make further easing too premature as lending rates are yet to adjust to the previous cut in January," said Alex Muiruri, a fixed income trader at African alliance Investment Bank. That certainly goes against the Wazua consensus. Tutajua... GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Hehe..studio hustla-ish. What the economy needs is a real stimulus for wealth creation & income generation. Import commodities have come off significantly.

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

The Bourse opened the week on a high note, with a total of 44M shares valued at Kes.761M transacted against Kes.636M on 45M shares posted last Friday.

The NSE 20 Share Index was up 25.25 points to stand at 4846.43.

All Share Index (NASI) was up 0.93 points to stand at 120.99.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Negates the banks lending rates slash call - http://www.businessdaily.../-/6s7xm2z/-/index.html GoK is crowding the credit market... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

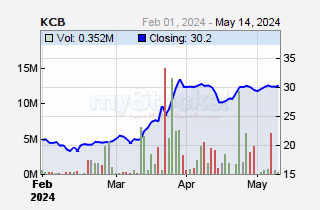

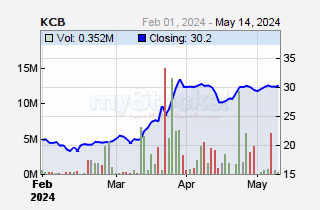

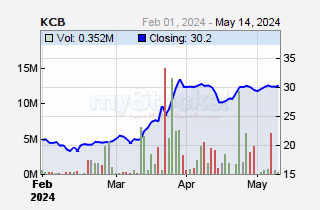

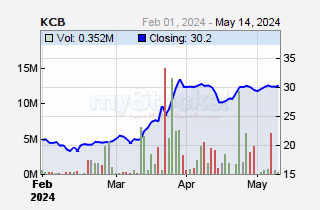

May 13th it goes exdiv... Chart looks toppish. Big support around 35.  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 6/17/2009 Posts: 1,623

|

hisah wrote:May 13th it goes exdiv... Chart looks toppish. Big support around 35.  I am no cartoonist,@hisah...what do they tell you on EABL..now crossing the 330 mark yet the demand is still robust,i gave up trying to understand it. Even that KCB could sustain the current prices if foreigners sustain their bidding ex dividend.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Bank stocks all up. Market warming up for a rate slash  @SufficientlyP

|

|

|

Rank: Elder Joined: 11/7/2007 Posts: 2,182

|

It would be interesting to see a rates slash, ni leo na yote yatabainika. LOVE WHAT YOU DO, DO WHAT YOU LOVE.

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

hisah wrote:May 13th it goes exdiv... Chart looks toppish. Big support around 35.  This one will need Heavy duty Gas Munroe shock absorbers post 13th  Wonder why the Q1 results delay? Over to @Obiero for the latest at the Exchange bar @SufficientlyP

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Serious volumes around simba and member AON(as of now). @Mwekezaji needed to shed more light on foreign participation so far! @SufficientlyP

|

|

|

Rank: Elder Joined: 6/2/2008 Posts: 1,438

|

Sufficiently Philanga....thropic wrote:Serious volumes around simba and member AON(as of now).

@Mwekezaji needed to shed more light on foreign participation so far! As at 11.35 a.m. Equity Bank - Foreigners are 26.32% NET SELLERS; while on KCB - Foreigners are 99.55% NET BUYERS. It looks like they are rotating out of Member into the Lion. Are they trying to get in on Simba's dividends or what is the story here?

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Many thanks @mwanahisa. That foreign participation data is interesting. Me thinks they're being duped into Simba. They could be net sellers post Q1 results  @Obiero, we are still here!/?,!) @SufficientlyP

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Sufficiently Philanga....thropic wrote:Many thanks @mwanahisa. That foreign participation data is interesting. Me thinks they're being duped into Simba. They could be net sellers post Q1 results  @Obiero, we are still here!/?,!) Also to note is that Memba has recorded the highest net foreign outflow in the market over the past two weeks (Week ending 26th April, net foreign outflow - USD334.4K; week ending 3rd May, net foreign outflow - USD1,004.1K). Over the same period, Simba has recorded net foreign inflow of USD 2,158.90. Foreign funds rotation is a strong hypothesis here. ... foreigners in Memba mus have been spooked by the high turnover of CFOs, unsatisfactory quality of the Q1 2013 growth and the below chart (#post 3256) On Simba Q1 2013 results, @Rich is calling +20% growth while @Obiero (Xchange Bar) & @guru are calling flat to negative growth #Now_Waiting #Simba_is_Reporting_this_Week

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

#Memba - Note its behavior every time its RSI hits over 70

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

mwekez@ji wrote:#Memba - Note its behavior every time its RSI hits over 70  Interearing that RSI observation. Didnt know it had actually hit 70. Needs to come down for foreign interest to pick. Fundamentally,the NPL ratio spike by more than 50% y/y, as you well noted needs some urgent address. @SufficientlyP

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

cnn wrote:hisah wrote:May 13th it goes exdiv... Chart looks toppish. Big support around 35.  I am no cartoonist,@hisah...what do they tell you on EABL..now crossing the 330 mark yet the demand is still robust,i gave up trying to understand it. Even that KCB could sustain the current prices if foreigners sustain their bidding ex dividend. EABL and mpesa bank have been on boosters since Nov 2012 - that Ethiopian special agreement deal. Foreign bids have been relentless and on huge volume...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

mwekez@ji wrote:Sufficiently Philanga....thropic wrote:Many thanks @mwanahisa. That foreign participation data is interesting. Me thinks they're being duped into Simba. They could be net sellers post Q1 results  @Obiero, we are still here!/?,!) Also to note is that Memba has recorded the highest net foreign outflow in the market over the past two weeks (Week ending 26th April, net foreign outflow - USD334.4K; week ending 3rd May, net foreign outflow - USD1,004.1K). Over the same period, Simba has recorded net foreign inflow of USD 2,158.90. Foreign funds rotation is a strong hypothesis here. ... foreigners in Memba mus have been spooked by the high turnover of CFOs, unsatisfactory quality of the Q1 2013 growth and the below chart (#post 3256) On Simba Q1 2013 results, @Rich is calling +20% growth while @Obiero (Xchange Bar) & @guru are calling flat to negative growth #Now_Waiting #Simba_is_Reporting_this_Week Waiting to see the NPL item. If it looks like Equity's then CBK will likely be forced to start cutting rates going forward...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

There will be a huge gap between KCB and Equity Bank Pretax Profit Items...EB is ahead by a long shot but KCB can still suprise! CFC Stanbic Q1 13 PBT likely to come in between 50-100% over last year!

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|