Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

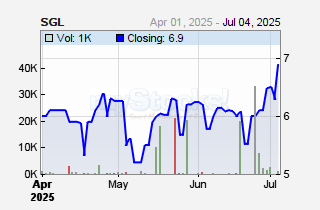

@ hisah. Thanks for those charts, they clear the mind. I know you insist you are a trader, but i think you are a fundie who trades. Because you choose undervalued counters and are very cautious about over valued ones (just like a value investor). On SGL, i looked at it last year when it was in the 20-23. And i realized it was over valued. NAV was about 19, with a poor div and no overly significant growth from anywhere so i passed. I'd be really shocked if 20 printed again any time soon. Which of the insurance counters have more leg room? If CFCI were to go sub 10 while cum div(can you believe it!), i think it may be worth a pop. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

I see a relief rally coming up too but when the reversal comes we might see 4,600s. The relief rally will open a window for those recently hung and that's where the harder sell-off should emerge IMO.

|

|

|

Rank: Elder Joined: 7/11/2012 Posts: 5,222

|

hisah wrote:youcan'tstopusnow wrote:NSE-20 up 20.86 points today to 4785.38

NASI shed 0.06 points to 117.41

For the week:

Week on week, turnover

declined to Kes.1.6bn from Kes.3.2bn posted the previous week, the number of shares traded stood at 117M against a hefty tally of 178M the

previous week.

The NSE 20 Share Index

shaved-off a total of 82.91 points during the week to stand at 4785.38.

All Share Index (NASI) was down 1.33% during the week to settle at 117.41 points.

Another down week. In short April has been a profit taking month. I expect a bounce from here into May for 1 - 2 weeks then the downtrend resumes to close the 4600 - 4700 gap. The sooner it happens the better.

@mukiri - I hope you now understand the VIP ticket selling analogy.

Ugliest chart of the month is SG. This stock will likely remain down there till year end as per volume spread! 20 or lower will print. Likely to be in the losers list of the year.

Leave early, let others eat too and woe unto he whom will buy at peak prices? Ama? I assume you are in cash?

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@aguy - not fully in cash. But I'm more liquid than last year courtesy of kcb complete offload as well as mpesa bank partially. Looking for quality now. KK needs to cooperate with my contra play below 9 else I'll sail in Total (I dislike the small available share float). JHL needs to report asap so that I pick the insurance boat for 2014 i.e. britank, jhl or kenya re. Insurance is the hot chick in 2013 and this sector will outperform even that expensive CIC. I don't like banks this year unless they lower lending rates. Hesitant to add to member until this lending hard ball breaks down. I had a look at TPS, tempting but lousy share liquidity like jhl or total or agri counters. As a trader available share float is part of the game plan. This is what I want going foward; liquidity, liquidity, liquidity... Markets thrive on this - http://www.businessdaily.../-/v4ecx3z/-/index.html Then the national budget in June. Economic stimulus must be addressed. If not 5000 remains a solid barrier for the year... If a eurobond is declared a real deal, then it's all systems go and industrials will start racing harder than banks  May 1st being a holiday I don't see NSE finishing April nor starting May with a solid buy tempo. MPC meeting in May will see if the bulls get their mojo back. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

@hisah 7.5x over-sub kwa maChirani ~> Rwanda sees heavy demand for debut $400M Eurobond http://news.yahoo.com/rw...-061021958--finance.html

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Rate cut(s) + Positive Q1's = Impetus for a great year GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

youcan'tstopusnow wrote:Rate cut(s) + Positive Q1's = Impetus for a great year

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

The Bourse opened the week with a total of 12M shares valued at Kes.278M, down from Kes.286M on a volume of 19M shares posted last Friday.

The NSE 20 Share Index shed 22.30 points to settle at 4763.09.

All Share Index (NASI) eased 0.05 points to stand at 117.36

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

FTSE NSE indices have rallied (btwn 1.3 and 1.4%) on the last day of April. NSE20 will bounce today, but needs to close 2% up to regain the 4860 monthly open level. Highly unlikely. Closing below 4860 will trigger a monthly trend reversal and more selling is coming next month. Keep a close eye on mpesa bank for it weighs heavily on the index metric and I expect a selloff on this counter post results esp if they're very rosy... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

After official close the FTSE NSE indices have scaled off the earlier stated gains and closed below 1%. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

NSE wrote:Buoyed by the sale of KCB shares, turnover rose to Kes.580M on a volume of 27M shares,

up from Kes.278M on 12M shares posted yesterday.

The NSE 20 Share Index notched up 2.14 points to stand at 4765.23.

All Share Index (NASI) was up 0.71 points to stand at 118.07.

Closes the month below 4860 triggering the monthly reversal... Sweet discounts coming up  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 8/16/2012 Posts: 661

|

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

hisah wrote:NSE wrote:Buoyed by the sale of KCB shares, turnover rose to Kes.580M on a volume of 27M shares,

up from Kes.278M on 12M shares posted yesterday.

The NSE 20 Share Index notched up 2.14 points to stand at 4765.23.

All Share Index (NASI) was up 0.71 points to stand at 118.07.

Closes the month below 4860 triggering the monthly reversal... Sweet discounts coming up  That's what I'm afraid of

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

symbols wrote:hisah wrote:NSE wrote:Buoyed by the sale of KCB shares, turnover rose to Kes.580M on a volume of 27M shares,

up from Kes.278M on 12M shares posted yesterday.

The NSE 20 Share Index notched up 2.14 points to stand at 4765.23.

All Share Index (NASI) was up 0.71 points to stand at 118.07.

Closes the month below 4860 triggering the monthly reversal... Sweet discounts coming up  That's what I'm afraid of How can you be afraid of discounts?  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

hisah wrote:symbols wrote:hisah wrote:NSE wrote:Buoyed by the sale of KCB shares, turnover rose to Kes.580M on a volume of 27M shares,

up from Kes.278M on 12M shares posted yesterday.

The NSE 20 Share Index notched up 2.14 points to stand at 4765.23.

All Share Index (NASI) was up 0.71 points to stand at 118.07.

Closes the month below 4860 triggering the monthly reversal... Sweet discounts coming up  That's what I'm afraid of How can you be afraid of discounts?  Goes back to a previous post. http://wazua.co.ke/forum.aspx?g=posts&m=386532#post386532

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Rich view "The Equity Markets had been on an orderly Retreat for a while well 11 out of the last 12 Sessions to be exact.

The Equity Market finally snapped out of its Funk.

The Nairobi All Share firmed 0.71 points to close at 118.07.

The Nairobi NSE20 inched 2.14 points higher to close at 4765.23.

The Bull Market remains in tact and The Slew of Imminent Earnings Releases will be the Catalyst for a vigorous Rebound.

Safaricom closed at a 57 Month High.

Kenya Commercial Bank rallied 1.2% on heavy Volume and is within 1.176% of its All Time High.

Volumes picked up as Buyers stepped up to the Plate and bought the Drawdown."

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

I think I'll reserve my bearish sentiments.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Still keeping an eye on this for more accurate foreign trade behaviour... MSCI KE index  Btw I stopped posting MSCI stats after Bloomberg decided to move it to their professional product side. Seems someone is observing wazua  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

I need an index devoid of scon. The opposite of courage is not cowardice, it's conformity.

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|