Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Rank: Veteran Joined: 6/17/2009 Posts: 1,623

|

Cde Monomotapa wrote:In need of a FY'12 vs Q1'13 analysis. Over to @mwekezaji & Co. That quarter one 2013 vs quarter four 2012 i can't wait to have a look at...loan book growth and NPLs.

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

cnn wrote:Cde Monomotapa wrote:In need of a FY'12 vs Q1'13 analysis. Over to @mwekezaji & Co. That quarter one 2013 vs quarter four 2012 i can't wait to have a look at...loan book growth and NPLs. Comparing that article to this one reveals Q1 was very dull. Well, Mr. Mkt will decide on the valuations - Housing Finance posts Kshs 907 million full year profit http://www.housing.co.ke...illion-full-year-profit

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Housing finance is the new equity. @Obiero will regret for alighting too soon  Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

Hmmm new CBK prudential guidedelines in full swing!!!

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,192 Location: nairobi

|

Hfck will do so well this year.i cant dare sell and an interim div. Is coming 1H as we eat the fy div. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

This is where I get off.Enjoy the ride

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

NSE-20 up 20.86 points today to 4785.38 NASI shed 0.06 points to 117.41 For the week: Week on week, turnover declined to Kes.1.6bn from Kes.3.2bn posted the previous week, the number of shares traded stood at 117M against a hefty tally of 178M the previous week. The NSE 20 Share Index shaved-off a total of 82.91 points during the week to stand at 4785.38. All Share Index (NASI) was down 1.33% during the week to settle at 117.41 points. GOD BLESS YOUR LIFE

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

sparkly wrote:Housing finance is the new equity. @Obiero will regret for alighting too soon  @Obiero could be in a chase car already! The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,008 Location: nairobi

|

hahaha. @all. i made my money from hfck and now im invested elsewhere i.e kcb @23.25, kq @10.95, bk @17 and coop @ 16.85.. sio kuringa/kuwaudhi, but ever since i alighted, the bus has not moved anywhere, naiona tu around the corner and i can even jog towards it, if i decide to proceed with the journey :)

KQ ABP 4.48; MTN ABP 5.20

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

obiero wrote:hahaha. @all. i made my money from hfck and now im invested elsewhere i.e kcb @23.25, kq @10.95, bk @17 and coop @ 16.85.. sio kuringa/kuwaudhi, but ever since i alighted, the bus has not moved anywhere, naiona tu around the corner and i can even jog towards it, if i decide to proceed with the journey :) Why bk?

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,008 Location: nairobi

|

i would have loved to explain but i guess this article tells it all.. www.theeastafrican.co.ke...6/-/8l4w5oz/-/index.html

KQ ABP 4.48; MTN ABP 5.20

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

What's so special about a Rwandan bank with a 4.5% dividend yield and a P/E of 12?? If it Were in Kenya it would be one of the most expensive banks and yet it has nothing close to the same growth potential that some Kenyan banks have for the next five years (eg kcb, EB, HFCK & Co op) These Kenyan banks have their subsidiaries growing at 100-150% while Bk is only growing at a meagre 35%! Come 2014-15 you will probably realize selling HFCK was a big blunder  Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,008 Location: nairobi

|

guru267 wrote:What's so special about a Rwandan bank with a 4.5% dividend yield and a P/E of 12?? If it Were in Kenya it would be one of the most expensive banks and yet it has nothing close to the same growth potential that some Kenyan banks have for the next five years (eg kcb, EB, HFCK & Co op) These Kenyan banks have their subsidiaries growing at 100-150% while Bk is only growing at a meagre 35%! Come 2014-15 you will probably realize selling HFCK was a big blunder  hehe. umetumia words mingi sweety. even at 150% growth, the Kenyan banks [subs] in Rwanda are 10 times smaller than BK and with inferior dividend yields. It holds a near monopoly of government business and this is not expected to change in the near term since govt is a key shareholder in BK.. that said, HF is not a bad stock :)

KQ ABP 4.48; MTN ABP 5.20

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,008 Location: nairobi

|

na hii 150% umetoa wapi madam. labda ni sudan pekee yake. look at this www.businessdailyafrica....36/-/1kcvnv/-/index.html

KQ ABP 4.48; MTN ABP 5.20

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

youcan'tstopusnow wrote:NSE-20 up 20.86 points today to 4785.38

NASI shed 0.06 points to 117.41

For the week:

Week on week, turnover

declined to Kes.1.6bn from Kes.3.2bn posted the previous week, the number of shares traded stood at 117M against a hefty tally of 178M the

previous week.

The NSE 20 Share Index

shaved-off a total of 82.91 points during the week to stand at 4785.38.

All Share Index (NASI) was down 1.33% during the week to settle at 117.41 points.

Another down week. In short April has been a profit taking month. I expect a bounce from here into May for 1 - 2 weeks then the downtrend resumes to close the 4600 - 4700 gap. The sooner it happens the better.

@mukiri - I hope you now understand the VIP ticket selling analogy.

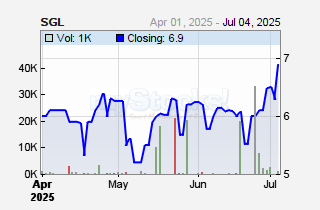

Ugliest chart of the month is SG. This stock will likely remain down there till year end as per volume spread! 20 or lower will print. Likely to be in the losers list of the year.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

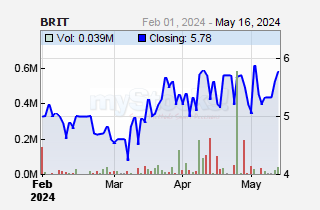

Britank's recovery is similar to that of Coop bank post listing hard selloff & rally. The listing price (9) is still a barrier until 9.50 is broken with volume spike. That 2nd upleg will be furious. For now insurance counters will consolidate till H1 results are availed. That upleg will sustain till year end. This is still the insurance counters year. Banks had their's last year. Now I wait for mpesa bank results. Let's see if the good news will sustain the buy pressure since Nov 2012. I never expected this elephant to clock above 5.80 in 2013 and I can only watch mr market crazy move. Now that NSE20 is in a reversal mood that is expected to spread into May, any heavy selling (10 - 15%) on mpesa bank post results (if EPS < 0.40) will make the index to sag more. For those still expecting 5400 to print this year, mpesa bank, eabl, member, bbk, coop, scbk, arm & bamburi need to rally at least 20% and sustain those levels. A big boost could also come from kk's recovery above 13. All these will need volume to spike on the bid side.  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/23/2010 Posts: 2,221 Location: Sundowner,Amboseli

|

Well put @Hisah    @SufficientlyP

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

guru267 wrote:What's so special about a Rwandan bank with a 4.5% dividend yield and a P/E of 12?? If it Were in Kenya it would be one of the most expensive banks and yet it has nothing close to the same growth potential that some Kenyan banks have for the next five years (eg kcb, EB, HFCK & Co op) These Kenyan banks have their subsidiaries growing at 100-150% while Bk is only growing at a meagre 35%! guru, I said as much in this post 4 weeks ago: youcan'tstopusnow wrote:RE BoK: obiero wrote:this stock deserves attention from keen investors. it is currently a real steal Current price - RwF. 200 P.E - 11.33 PBV - 2.115 Div Yield - 4.415% ROA - 3.65% ROE - 18.7% Total Assets rose 12.1% Customer Deposits grew 15.14% Loan to Deposit ratio stands at 88.8% GNPL/Loans Advanced is 2% obiero, what makes BoK stand out in comparison to its Kenyan peers and thus make investors prefer it to local banks? Kindly elaborate... GOD BLESS YOUR LIFE

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|