Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

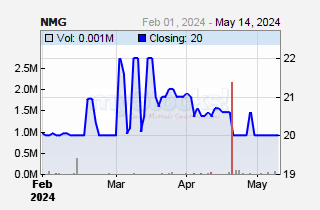

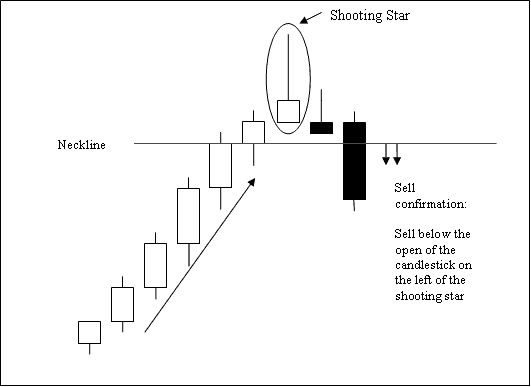

hisah wrote:Sanity is back on this media counter... Waiting for EABL, ARM and at some point Mpesa bank to mirror the same. Those discounts will eventually come.  So far the huge volume seen this week has not propped up the boat with FTSE NSE indices sliding the most today. I expect NSE20 to close below 4900 handle today. 4860 was the open for the month. If NSE20 closes below that level it will trigger a monthly reversal, which means May and possibly June will see more selling... In TA's candlestick pattern analysis a shooting star is already forming on the monthly chart, which means selling pressure is now increasing since the first day of trading began @5030 and we are ending lower than that point... Illustration courtesy of tradeforextrading.com  This is why I talked of selling some of my VIP tickets since I had already seen the show... Something that the NMG chart is not saying is that the counter had a bonus in ratio of 1:5 and a final dividend of KES 7.50. The books have closed and the ex all price should be KES 326/- (from the KES 400/-). The plunge to the current VWAP of KES 287/- is an overreaction by 13.5%. Any further downfall is welcomed for the buyers who want to re-enter/enter the counter. I expect the counter to soar as the market realizes that the counter benefited from elections and will report healthy 1H13 & healthy FY13 in line with econ factors.

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

sparkly wrote:Was a sweet ride on the media counter. Sold my last lot at 370. My re-entry will be between 180-190.  ... Mi2 looking forward to good re-entry level

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

NSE wrote:

Week on week, turnover soared to Kes.3.2bn from Kes.1.5bn posted the previous week, the number of shares traded stood at 178M against 102M the previous week.

NSE 20 Share Index shaved-off a total of 152.21 points during the week to stand at 4868.29.

All Share Index (NASI) was down 2.23% during the week to settle at 118.99

points.

4860... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

hisah wrote:NSE wrote:

Week on week, turnover soared to Kes.3.2bn from Kes.1.5bn posted the previous week, the number of shares traded stood at 178M against 102M the previous week.

NSE 20 Share Index shaved-off a total of 152.21 points during the week to stand at 4868.29.

All Share Index (NASI) was down 2.23% during the week to settle at 118.99

points.

4860... Interesting.

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

I joined Team Bear late last week. Got concerned about the smoke: larger volumes & signal: lower lows. By yesterday, the Bulls & Bears seemed to have gone into caucus with lower volumes but in favor of Team Bear. We'll resume this next week. #Awash

|

|

|

Rank: Elder Joined: 6/23/2009 Posts: 14,008 Location: nairobi

|

hisah wrote:sparkly wrote:hisah wrote:youcan'tstopusnow wrote:4 counters accounted for around 87% of market turnover of 1.194 Billion - KCB - 405M, EABL - 280M, Safaricom - 230M and Equity 119M

Yep, seen the decent turnover volume too. However, FTSE NSE15 which comprises the above counters slid by 0.39%. W/W FTSE NSE15 is 1.34% down and lower than Monday's open @158.26. Friday needs to close at the same level or above if indeed this volume is support. @Hisah, what do the cartoons say about Roar. Are we hitting 50 anytime soon or are we likely to go below 40? Above 40 simba is fighting a lot of resistance (selling). Price has stalled for a while, thus neutral in direction. Need more time to digest yesterday's huge volume. By end month we'll know. Likely to dip to KES 32.5 on release of Q1 with further slide to KES 30 on book closure

KQ ABP 4.48; MTN ABP 5.20

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

Don't be suprised by the current market move. Q2 2013 market forecast can be found here http://www.contrarianinv...013-strategy-and-outlook

|

|

|

Rank: Elder Joined: 3/19/2013 Posts: 2,552

|

Cde Monomotapa wrote:I joined Team Bear late last week. Got concerned about the smoke: larger volumes & signal: lower lows. By yesterday, the Bulls & Bears seemed to have gone into caucus with lower volumes but in favor of Team Bear. We'll resume this next week. #Awash Indeed,very confusing week.

|

|

|

Rank: Member Joined: 2/1/2010 Posts: 272 Location: Nairobi

|

mwekez@ji wrote:

Something that the NMG chart is not saying is that the counter had a bonus in ratio of 1:5 and a final dividend of KES 7.50. The books have closed and the ex all price should be KES 326/- (from the KES 400/-). The plunge to the current VWAP of KES 287/- is an overreaction by 13.5%. Any further downfall is welcomed for the buyers who want to re-enter/enter the counter. I expect the counter to soar as the market realizes that the counter benefited from elections and will report healthy 1H13 & healthy FY13 in line with econ factors.

Waiting for further correction to enter this counter. The harder you work, the luckier you get

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

[quote=the deal]Don't be suprised by the current market move. Q2 2013 market forecast can be found here http://www.contrarianinv...13-strategy-and-outlook[/quote] Interesting.

|

|

|

Rank: Elder Joined: 9/12/2006 Posts: 1,554

|

Why do some stocks sky rocket on a positive earnings surprise while others fall off a cliff?

In this article we are going to tackle this little-understood issue. Better yet, I will share with you two ways to profit from earnings surprises. More on that later.

3 Reasons Stocks Can Drop After a Positive Earnings Surprise

1) Estimates vs. Expectations: The standard definition of an earnings surprise is when actual earnings come in higher than earnings estimates. But those estimates are the "published" numbers from the brokerage analysts. Quite often investors tend to develop their own unique set of expectations that can differ greatly from the Wall Street analysts. If there is too much optimism ahead of the release, then actual earnings will need to be a blowout in order to appease investors' inflated expectations. This is the most common reason why some stocks fall after a "supposed" earnings beat.

2) Quality of Earnings: The highest quality earnings come from having robust revenue growth. This means that the company's products or services are in high demand and should stay that way into the future. However, these days far too much of earnings being reported is generated from cost cutting and other "accounting gimmickry". The problem with that is that the benefits of these moves don't last. When the market gets a whiff that the earnings are unsustainable, no matter how strong the beat, shares will most likely drop.

3) Forward Guidance: Plain and simple, when you buy a stock you are taking an ownership stake. And what owners of companies care about is the stream of future earnings. So if a company beats earnings for the quarter just reported, but warns that future quarters will see lower earnings, then that stock will go down...and go down fast.

By Steve Reitmeister

..I thought this would be a nice read for wazuans

|

|

|

Rank: Elder Joined: 9/12/2006 Posts: 1,554

|

Further to discussion above Steve adds.....

2 Ways to Make Money on Earnings Surprises

So now that we have outlined things that can go wrong after an earnings surprise, let's shift gears and talk about something even more important: How to turn a profit from earnings surprises. Here are two ways to go about it.

Good Way: Buy shares in any company that had an earnings surprise and rose the day following the news. These stocks experience what academics call the "Post Earnings Announcement Drift". Studies clearly show that these stocks usually outperform the market over the next 9 months. Conversely, you should sell any stock in your portfolio that misses its earnings numbers, as it likely to underperform the market for the next few quarters. The downside of this approach is that there are literally thousands of stocks to choose from every quarter.

Best Way: Find stocks where the earnings "whispers" tip you off that a big surprise is coming. Buy the shares shortly before the announcement and enjoy quick gains of 10%, 15%, 20% when the earnings surprise is officially reported.

I know what you're thinking. There are no Magic 8-balls for the stock market, so how can this be possible??? But fret not; this isn't a magic show. It's pure science.

The concept of finding a profitable source of earnings whispers has long been the Holy Grail of stock investing. Many experts have tried and failed to make this work. In fact, we had been researching this for 3 straight years.

|

|

|

Rank: Elder Joined: 9/12/2006 Posts: 1,554

|

Further to the above Steve adds

2 Ways to Make Money on Earnings Surprises

So now that we have outlined things that can go wrong after an earnings surprise, let's shift gears and talk about something even more important: How to turn a profit from earnings surprises. Here are two ways to go about it.

Good Way: Buy shares in any company that had an earnings surprise and rose the day following the news. These stocks experience what academics call the "Post Earnings Announcement Drift". Studies clearly show that these stocks usually outperform the market over the next 9 months. Conversely, you should sell any stock in your portfolio that misses its earnings numbers, as it likely to underperform the market for the next few quarters. The downside of this approach is that there are literally thousands of stocks to choose from every quarter.

Best Way: Find stocks where the earnings "whispers" tip you off that a big surprise is coming. Buy the shares shortly before the announcement and enjoy quick gains of 10%, 15%, 20% when the earnings surprise is officially reported.

I know what you're thinking. There are no Magic 8-balls for the stock market, so how can this be possible??? But fret not; this isn't a magic show. It's pure science.

The concept of finding a profitable source of earnings whispers has long been the Holy Grail of stock investing. Many experts have tried and failed to make this work. In fact, we had been researching this for 3 straight years.

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

Jamani wrote:Why do some stocks sky rocket on a positive earnings surprise while others fall off a cliff?

In this article we are going to tackle this little-understood issue. Better yet, I will share with you two ways to profit from earnings surprises. More on that later.

3 Reasons Stocks Can Drop After a Positive Earnings Surprise

1) Estimates vs. Expectations: The standard definition of an earnings surprise is when actual earnings come in higher than earnings estimates. But those estimates are the "published" numbers from the brokerage analysts. Quite often investors tend to develop their own unique set of expectations that can differ greatly from the Wall Street analysts. If there is too much optimism ahead of the release, then actual earnings will need to be a blowout in order to appease investors' inflated expectations. This is the most common reason why some stocks fall after a "supposed" earnings beat.

2) Quality of Earnings: The highest quality earnings come from having robust revenue growth. This means that the company's products or services are in high demand and should stay that way into the future. However, these days far too much of earnings being reported is generated from cost cutting and other "accounting gimmickry". The problem with that is that the benefits of these moves don't last. When the market gets a whiff that the earnings are unsustainable, no matter how strong the beat, shares will most likely drop.

3) Forward Guidance: Plain and simple, when you buy a stock you are taking an ownership stake. And what owners of companies care about is the stream of future earnings. So if a company beats earnings for the quarter just reported, but warns that future quarters will see lower earnings, then that stock will go down...and go down fast.

By Steve Reitmeister

..I thought this would be a nice read for wazuans Examples 1. TCL falling after posting 40% increase in PBT...investor expectations not met...share price surge in the run up to announcement confirms investors had too much optimism. 2. NMG rallying after posting 25% increase in PBT....Bonus shares the juicy suprise. 3. CIC stagnating after posting triple digit growth....Quality of earnings poor.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Cde Monomotapa wrote:hisah wrote:NSE wrote:

Week on week, turnover soared to Kes.3.2bn from Kes.1.5bn posted the previous week, the number of shares traded stood at 178M against 102M the previous week.

NSE 20 Share Index shaved-off a total of 152.21 points during the week to stand at 4868.29.

All Share Index (NASI) was down 2.23% during the week to settle at 118.99

points.

4860... Interesting. The up and downs of investing, making money. Life is short. Live passionately.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

BAT, EABL, ARM & mpesa bank price stability are slowing down the leakage. However if prices of mpesa bank post results slide 10% plus as well as kcb exdiv plus EABL, NSE20 will easily slide beyond 4700. Crital support for 2013 is 4375 - 4400.

However I'm cool with the current correction since it has now closed the euphoria round 2 gap. Remember gaps eventually get filled. NSE20 shot up from 4860 to 5030 leaving a 190pt gap. This I explained would happen as the euphoria returned post election court ruling.

Still very few counters exit that are fairly priced meaning the correction will continue in May. This should bring sense back to the crap boatload of paka and olympia as well as others that have raced too far beyond fundies due to euphoria.

The next bull upleg has 5030 as its current challenge before resuming uptrend. But remember that 5000 upwards is solid resistance and a lot of buy volume (pressure) is need to break it down. The 10yr chart shows the choppiness (ups & downs)within the 5000 levels. Actually 6000 plus is weaker resistance than the 5000 levels. Breaking 5900 will see NSE20 racing to new all time highs beyond 6161...

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:guru267 wrote:hisah wrote:Mukiri wrote:hisah wrote:Political barrier partially removed. ICC barrier still pending for the fearful bull.

If April 9 is gazetted a holiday it means NSE will have 2 weeks of 4 trading days each. This should elicit some fierce bidding as the trading contest ensues on the short trading period within those 2 weeks.

I will be selling to wanjikus at this point...  And if the counters keep going higher and higher after you sell? At this point many are late for the party! Think of it like buying an early ticket or a show ticket at the gate. The gate ticket is always expensive and yet you don't get the best sitting place... So I'll be selling my VIP ticket at the gate as I've already seen the show!

Buying in a euphoria (buying frenzy or bid-fest cocktail) will always get you trapped and you'll be buying the top  Then the same lot will sell in a huff when they experience no demand as the DJ stops the music. Then the discounts become attractive once again and the rally begins. Then the same lot will sell in a huff when they experience no demand as the DJ stops the music. Then the discounts become attractive once again and the rally begins.

Markets are not that hard to understand if you remove the emotions.

Remember there will always be a next bus. Never rush your investment goals...

@hisah the bull that is coming is simply a re rating process as Kenya*s political risk profile falls... Stocks with P/Es of 9-12 will rally to P/Es of 12-15 and stocks at 3-6 P/E should see the largest rally to 7-9 P/E ratios.. Definitely a re-rate is coming. But most bluechips are too lofty for now. They're the ones that plot the indices' direction. A euphoria push past 5100 on NSE20 in a short period is unsustainable unless huge volume comes in. My euphoria participation will be to take profit. Only chase fair valued or cheap valued counters.

NSE20 has a gap between 4600 & 4700 as mini euphoria spiked. Gaps always get filled (a shakeout of weak hands for discount bargains). If that gap is revisited with huge volume, the next bull will be ready and with more power than the current teen bull. Hydrocarbons will be the mother booster... Solid legs.

The likely euphoria this week will create another gap into solid resistance levels (5000-5100). Gaps are not solid support legs.

Had forgotten about that gap between 4600 & 4700 level. That too needs to get filled (closed) to create stable support. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:the deal wrote:Its very easy to get carried away in a bull run...lets see what happens when the market clocks above 5000...valuations are currently above historic levels on most bluechip companies...we need strong earnings....super dividends...to keep the market excited....if nothing of that sort happens then a correction will come...I'm more worried about the current twin deficits (current & fiscal)...the effect of this deficits is that Treasury will have to borrow excessively resulting in yields in the fixed income market rising and its happening...3 month T-Bill yield 10.3% while inflation at 4.1%...once T-Bills creep to 15-20% consider this bull run slaughtered....guys will move money from stocks to bonds...banks will pass the cost of funds into the economy....I think thats the red flag for now. True. If Tbills spike to 15% and above the rally will meet a brick wall... @deal saw the market complacency too...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

hisah wrote:hisah wrote:the deal wrote:Its very easy to get carried away in a bull run...lets see what happens when the market clocks above 5000...valuations are currently above historic levels on most bluechip companies...we need strong earnings....super dividends...to keep the market excited....if nothing of that sort happens then a correction will come...I'm more worried about the current twin deficits (current & fiscal)...the effect of this deficits is that Treasury will have to borrow excessively resulting in yields in the fixed income market rising and its happening...3 month T-Bill yield 10.3% while inflation at 4.1%...once T-Bills creep to 15-20% consider this bull run slaughtered....guys will move money from stocks to bonds...banks will pass the cost of funds into the economy....I think thats the red flag for now. True. If Tbills spike to 15% and above the rally will meet a brick wall... @deal saw the market complacency too... Yields on the 91, 182 & 364 day papers have recently been on decline. This Wed, CBK will also auction 5 & 15 year papers. If the rates don't spike you should reverse your insipid market call

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

mwekez@ji wrote:hisah wrote:hisah wrote:the deal wrote:Its very easy to get carried away in a bull run...lets see what happens when the market clocks above 5000...valuations are currently above historic levels on most bluechip companies...we need strong earnings....super dividends...to keep the market excited....if nothing of that sort happens then a correction will come...I'm more worried about the current twin deficits (current & fiscal)...the effect of this deficits is that Treasury will have to borrow excessively resulting in yields in the fixed income market rising and its happening...3 month T-Bill yield 10.3% while inflation at 4.1%...once T-Bills creep to 15-20% consider this bull run slaughtered....guys will move money from stocks to bonds...banks will pass the cost of funds into the economy....I think thats the red flag for now. True. If Tbills spike to 15% and above the rally will meet a brick wall... @deal saw the market complacency too... Yields on the 91, 182 & 364 day papers have recently been on decline. This Wed, CBK will also auction 5 & 15 year papers. If the rates don't spike you should reverse your insipid market call @mwekezaji - for tbills to clock 15% plus there must be a nasty market event.

I reposted @deal's comment due to his similar view about 5000pts plus on the NSE coming too fast ahead of fundies. Some counters have prices that call for super results to justify their lofty premiums... The period of rerating the election premium is now done. Next move must come from fundies valuations before ICC gives another political premium boost. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|