Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Interesting article on Buffett's first 5 years http://richcash8tradeblo...made-his-first.html?m=1

GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

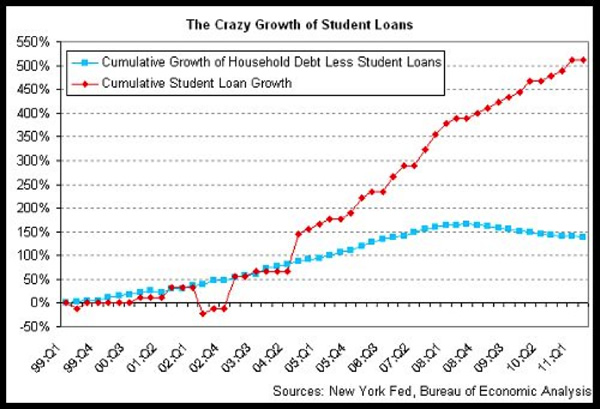

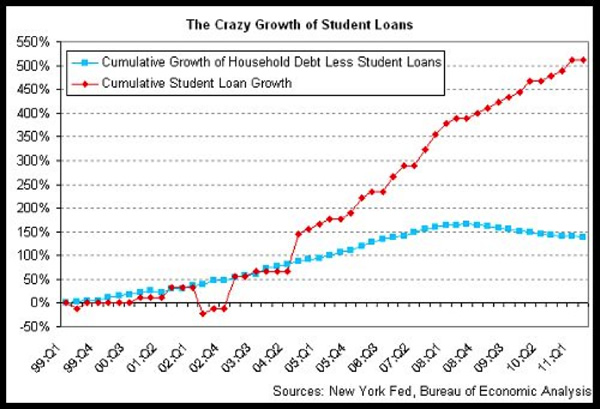

Parabolic student loan growth vs a limping economy. Indeed the 1st world is getting ready for 3rd world jobless status... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

hisah wrote: Parabolic student loan growth vs a limping economy. Indeed the 1st world is getting ready for 3rd world jobless status... SMH. HELB like shakedowns coming soon?

|

|

|

Rank: Elder Joined: 2/23/2009 Posts: 1,626

|

In the past the parents of the children taking these students loans we taking house loans. Student loans are a kind of luxury because unlike houses,they show no value in the economy until people start utilizing that knowledge in the economy and sadly graduate employment levels are not catching up to the graduates. Uncertainty is certain.Let go

|

|

|

Rank: Elder Joined: 2/23/2009 Posts: 1,626

|

I'm looking at rich live data and a Government bond has had a 12.20% rise in price. Do we have any Gary Shilling/Bond traders/investors to tell us the in's and out's of bond trading especially considering small trades. Uncertainty is certain.Let go

|

|

|

Rank: Elder Joined: 4/22/2010 Posts: 11,522 Location: Nairobi

|

ChessMaster wrote:I'm looking at rich live data and a Government bond has had a 12.20% rise in price. Do we have any Gary Shilling/Bond traders/investors to tell us the in's and out's of bond trading especially considering small trades. ...the problem with bond odd lots (less than 100m is considered an odd lot) is disposing them can be quite difficult,maybe the CMA,NSE and CBK should be looking at opening a platform where small traders can sell their bonds with ease...at the moment if you hold such you will lucky to sell to the small players,small insurance guys and asset managers etc... possunt quia posse videntur

|

|

|

Rank: Elder Joined: 2/23/2009 Posts: 1,626

|

maka wrote:ChessMaster wrote:I'm looking at rich live data and a Government bond has had a 12.20% rise in price. Do we have any Gary Shilling/Bond traders/investors to tell us the in's and out's of bond trading especially considering small trades. ...the problem with bond odd lots (less than 100m is considered an odd lot) is disposing them can be quite difficult,maybe the CMA,NSE and CBK should be looking at opening a platform where small traders can sell their bonds with ease...at the moment if you hold such you will lucky to sell to the small players,small insurance guys and asset managers etc... Wish they would.Bonds are supposed to be liquid.Dec 2011 I got tempted to get into bonds because of the rates at that time but opted not to. Uncertainty is certain.Let go

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

The McKinsey Global Institute Report titled "Lions on the Move: The Progress and Potential of African Economies" (http://www.mckinsey.com/insights/mgi/research/productivity_competitiveness_and_growth/lions_on_the_move) provides an insightful chart on Africa's capital inflows on pg. 54. Note that the low in Foreign Direct Investment was in 1990. The major high was in 2007 marking a 17 year bull market. Although not on the chart, 2011 was significant as the beginning of the European Debt Crisis. Going forward, 2016 is standing out as a major turning point due perhaps to the Debt Crisis landing fairly and squarely on the shores of the United States. "JOHANNESBURG- Norway's $680-billion sovereign wealth fund is looking at Africa with interest as it seeks to take advantage of the region's rapid growth and diversify its portfolio, a senior official said on Wednesday. The world's largest sovereign fund has investments in Egypt, South Africa and Morocco but sees opportunities in other African countries, though their capital markets are still developing, Deputy Chief Executive Trond Grande told Reuters. "Other African nations are improving their capital markets. You see that growth is high there," Grande said. "They are of interest for this fund as well, as we're trying to be as globally diversified as possible." Read more: http://www.engineeringne...ica-exposure-2012-12-19

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

karanjakinuthia wrote:The McKinsey Global Institute Report titled "Lions on the Move: The Progress and Potential of African Economies" (http://www.mckinsey.com/insights/mgi/research/productivity_competitiveness_and_growth/lions_on_the_move) provides an insightful chart on Africa's capital inflows on pg. 54. Note that the low in Foreign Direct Investment was in 1990. The major high was in 2007 marking a 17 year bull market. Although not on the chart, 2011 was significant as the beginning of the European Debt Crisis. Going forward, 2016 is standing out as a major turning point due perhaps to the Debt Crisis landing fairly and squarely on the shores of the United States. "JOHANNESBURG- Norway's $680-billion sovereign wealth fund is looking at Africa with interest as it seeks to take advantage of the region's rapid growth and diversify its portfolio, a senior official said on Wednesday. The world's largest sovereign fund has investments in Egypt, South Africa and Morocco but sees opportunities in other African countries, though their capital markets are still developing, Deputy Chief Executive Trond Grande told Reuters. "Other African nations are improving their capital markets. You see that growth is high there," Grande said. "They are of interest for this fund as well, as we're trying to be as globally diversified as possible." Read more: http://www.engineeringne...ica-exposure-2012-12-19

That McKinsey report always gives me a good feeling whenever I review it.

But are the African small economies esp financial markets ready for sizable hot money without suffering record inflation due to assets overheating?$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/23/2009 Posts: 1,626

|

hisah wrote:karanjakinuthia wrote:The McKinsey Global Institute Report titled "Lions on the Move: The Progress and Potential of African Economies" (http://www.mckinsey.com/insights/mgi/research/productivity_competitiveness_and_growth/lions_on_the_move) provides an insightful chart on Africa's capital inflows on pg. 54. Note that the low in Foreign Direct Investment was in 1990. The major high was in 2007 marking a 17 year bull market. Although not on the chart, 2011 was significant as the beginning of the European Debt Crisis. Going forward, 2016 is standing out as a major turning point due perhaps to the Debt Crisis landing fairly and squarely on the shores of the United States. "JOHANNESBURG- Norway's $680-billion sovereign wealth fund is looking at Africa with interest as it seeks to take advantage of the region's rapid growth and diversify its portfolio, a senior official said on Wednesday. The world's largest sovereign fund has investments in Egypt, South Africa and Morocco but sees opportunities in other African countries, though their capital markets are still developing, Deputy Chief Executive Trond Grande told Reuters. "Other African nations are improving their capital markets. You see that growth is high there," Grande said. "They are of interest for this fund as well, as we're trying to be as globally diversified as possible." Read more: http://www.engineeringne...ica-exposure-2012-12-19

That McKinsey report always gives me a good feeling whenever I review it.

But are the African small economies esp financial markets ready for sizable hot money without suffering record inflation due to assets overheating? Plus they are also working on how to get African's in the diaspora to invest more in Africa. Uncertainty is certain.Let go

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

This is what world bank is seeing about Africa. See video - http://bit.ly/iw2w4a $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Enkereri Mara (masai mara), a five star premium hotel brand owned by Dubai’s Emaar Property, one of the world’s most valuable companies. The owners of Burj Khalifa picked out KE and Egypt for their new ventures. Big money, follows (attracts) big money. Waiting to see which VIPs troop to Enkereri once it's opened this year.  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Barclays, Deutsche Bank to cut pay up to 20 percent - http://www.reuters.com/a...y-idUSBRE90D0PI20130114

Quote:Barclays and Deutsche Bank will take a knife to bonuses for investment bankers in the coming weeks as they seek to tackle high costs, people familiar with the matter said.

Britain's Barclays is finalizing bonuses for last year and overall 2012 compensation for investment bankers will fall by between 10 percent and 20 percent on average, two sources said.

New Barclays CEO Antony Jenkins is revamping the bank and has pledged to cut pay to lift returns for investors.

Deutsche Bank's investment bankers will see bonuses for 2012 fall by 15-20 percent, two sources said.

The reduction follows a year of restructuring at Germany's flagship bank and pressure from regulators to clamp down on short-term rewards. Demotivated investment bankers equals... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/11/2012 Posts: 5,222

|

hisah wrote:Enkereri Mara (masai mara), a five star premium hotel brand owned by Dubai’s Emaar Property, one of the world’s most valuable companies. The owners of Burj Khalifa picked out KE and Egypt for their new ventures. Big money, follows (attracts) big money. Waiting to see which VIPs troop to Enkereri once it's opened this year.  When one is next to this building, say Dubai Mall, you'll have to look at it in halves. The Prince doesn't joke. Kenya is attracting big money, Flavio's Malindi resort

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Hedge Funds Most Levered And Long Since 2004! http://www.elliottwavema...ed-and-long-since-2004/

Quote:"Leverage among managers who speculate on rising and falling shares climbed to the highest level to start any year since at least 2004, according to data compiled by Morgan Stanley.” Such extremes always warn of sharp reversals! Indeed the fattening fest is at hand. @stockmaster may have a point and this is global! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

RBS braced for up to $800 million Libor fines - http://reut.rs/13yRxWa

Quote:Royal Bank of Scotland is braced for fines of between 400 million pounds and 500 million pounds ($803 million) for its role in an interest rate rigging scandal, sources familiar with the matter said.

The partly state-owned bank is expected to agree a settlement with authorities in Britain and the United States next week and will be hit with a worse punishment than rival Barclays, which was fined $450 million last June.

However, the sources stressed the final number had not yet been decided by all of the regulators involved. Although Britain's financial regulator has completed its investigations, probes by U.S. authorities are continuing, they said.

RBS's fines will, however, be well short of the record $1.5 billion punishment which was meted out to Switzerland's biggest lender UBS last month.

LIBOR scandal sin ticket continues to climb... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Fitch warns U.S. AAA at risk from debt ceiling struggle - http://www.reuters.com/a...h-idUSL6N0AK60Q20130115

Quote:There is a material risk the United States would lose its triple-A if there is a repeat of 2011 wrangling over raising the country's self-imposed debt ceiling, rating firm Fitch said on Tuesday. Will there be a downgrade in March 2013? A confluence of a market top also hoovers around this period... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Through Columbia Global Centre, which was opened by President Kibaki on Monday, Kenya becomes the only country in Africa to host an institution that seeks to apply modern technology to solve contemporary development challenges. http://www.businessdaily.../-/fbkk4tz/-/index.html

GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

BundesBank retrieves $200 billiion gold reserves from US & France storage vaults -- http://www.guardian.co.u...eve-200bn-gold-reserves

I'm still digesting this information!? What the heck?! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

The Tao of Markets

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|