Wazua

»

Investor

»

Stocks

»

New Year Resolutions

Rank: Elder Joined: 7/11/2012 Posts: 5,222

|

maka wrote:mlennyma wrote:Whether monkey or what i believe every stock will have its day. ...am with you on this one the problem with akina s.mutaga 3 and co is that you put a lot of fundamental and technical analysis in a market that reacts rarely on such...i once sold eveready at 28,scom at 6.40...if all goes well and the market gathers the right momentum probably to 500 pts onwards every stock will indeed have its day...this is the Nairobi securities exchange we are talking about,where stocks can reach a high of 900 in a couple of dayz...   Hear, hear. Safcom 6.40? That must have been immediately after IPO

|

|

|

Rank: Member Joined: 4/19/2007 Posts: 68

|

Amount invested to date: 1,768,562 Market value: 636,734 Lose from liquidation: - 1,131,828.00 Buy Rea Vipingu: 300,000 Commissions: 6,300 Number of shares: 14,685 Dividend income (1.50) 22,027.50 Buy Housing Finance: 300,000 Commissions: 6,300 Number of shares: 18,987 Dividend income (0.70) 13,290.90 Buy Mumias: 300,000 Commissions: 6,300 Number of shares: 57,588 Dividend income (0.50) 28,794.00 Cash lost/gained to date - 1,067,716.00 S.Mutaga III wrote:From your current position I would:

1 ) Liquidate all my nse holdings.

2 ) With the proceeds, I would buy into three income stocks.

Rea Vipingo:- Payday is nearing.With a projected dividend of 1.5 per share, you can get a return of about 6% of your investment in two months.After books closure,the price will tank a little presenting you with an opportunity to increase your holding.

Housing Finance:- Payday is coming soon and you will start reaping the benefits of your investment. It is trading at a dividend yield of >9%.

Mumias Sugar:- At a dividend yield approaching 10% and with diversification,buy it even though it is trading ex dividend. Dont stick around if there is a rihts issue.

Disclaimer:- Dont take positions in a counter all at once. Buy a chunk and then seek to average down as you get the cash.This will reduce the chances of error and also reduce your buying price.

#Goodluck#

|

|

|

Rank: Member Joined: 8/17/2011 Posts: 207 Location: humu humu

|

I truly feel sorry for you. All is not lost though, i wont tell you which stocks to pick or sell only that you change your investment adviser without delay.

|

|

|

Rank: Member Joined: 8/17/2011 Posts: 207 Location: humu humu

|

I truly feel sorry for you. All is not lost though, i wont tell you which stocks to pick or sell only that you change your investment adviser without delay.

|

|

|

Rank: New-farer Joined: 11/12/2012 Posts: 92

|

I donno what to say....I feel so grieved reading this...

|

|

|

Rank: Member Joined: 4/19/2007 Posts: 68

|

I need an investor who has the confidence to show their warts and all, there are too many theorists out here. Rudisha does not tell you how to win a race he shows you how. kaifastus wrote:I truly feel sorry for you. All is not lost though, i wont tell you which stocks to pick or sell only that you change your investment adviser without delay.

|

|

|

Rank: Elder Joined: 6/20/2012 Posts: 3,855 Location: Othumo

|

pole boss  Thieves

|

|

|

Rank: Veteran Joined: 2/10/2010 Posts: 1,001 Location: River Road

|

@stocksguru my view is that if you are emotionally strong to sell, just hold the positions but you need to diversify into bonds as you approach retirement. On access...no need to average down on this one, when you are in a hole stop digging

KQ is airline stocks on that I will repeat what I said when KQ was a star stock on wazua in 2010 from Warren Buffet- airlines eat capital.

"If a capitalist had been present at Kitty Hawk back in the early 1900s, he should have shot Orville Wright. He would have saved his progeny money. But seriously, the airline business has been extraordinary. It has eaten up capital over the past century like almost no other business because people seem to keep coming back to it and putting fresh money in.

I have an 800 number now that I call if I get the urge to buy an airline stock. I call at 2 in the morning and I say: 'My name is Warren, and I'm an aeroholic.' And then they talk me down."

"How do you become a millionaire? Make a billion dollars and then buy an airline." -- Warren Buffett"

|

|

|

Rank: Veteran Joined: 2/3/2010 Posts: 1,797 Location: Kenya

|

stocksguru wrote:How long is very long and how young is young? I have clearly indicated that I am reducing my holdings in stocks that will not be recovering soon and which means that I agree with your analysis. What I am doing is moving forward from why I am standing, your statements makes it seem that I have just taken a position which is a wrong assumption, maybe you could share your portfolio so that we can see how you have applied your knowledge of the market and the companies. Please appreciate the fact that I can only move from my current position, starting from an imaginary position would be fool hardy and deceitful both to you and to myself. You cannot budget based on an expected salary you budget based on your current salary and situation one cannot wish away their age, marital status, number of children or current employment. What I have posted is my portfolio as it stands this morning a situation that qualifies as water under the bridge what is important is what I do from here going forward. I promise to post my portfolio at the end of the 1st quarter at which point you will be justified in judging my decisions. S.Mutaga III wrote:The only valid reason for buying into your proposed counters is that you are buying into a very long term investment.Long term investments are for young people.   @stocksguru it takes courage to bare your portfolio like youve done. that in itself shows you have stopped digging and are sure to get out of the hole. Ditch access for KCB I may be wrong..but then I could be right

|

|

|

Rank: Member Joined: 4/15/2008 Posts: 234

|

stocksguru wrote:Amount invested to date:

Cash lost/gained to date - 1,067,716.00

Always Have an Exit Strategy. At 10%loss on any stock, I will exit no matter what. As for profits, I will ride the wave until it begins a downward trend and thats when I exit and re-calculate the stock a fresh. Secondly, For such an amount your mony would have been safer in a bluechip stock that is posting profits. Always do a background check on the counter you are about to invest in. For Access, eveready the story was already written. Not to be seen as too bold but looking at KCB growing from single digit profit in billions t double digits you cant but help seeing this stock going alittle bit higher. Take time and evaluate CFCi. It could be your deal breaker. Caution though - Its coming from a background of a loss occasioned by a business amalgamation. Do it today! Tomorrow is promise to no-one.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

Good for you to share your strategy on Wazua. You want us to give you candid feedback, right? We will and it will be painful to swallow but it will help you.stocksguru wrote:As the new year begins I am setting up a strategy for my portfolio which has gone off during the past 2 years. I get the impression that you don't do your own research. You just fall in love with a stock and rush to buy when you notice that it is falling, hoping that it will go back to the prior highs and you will make a killing. You also love penny stocks because they appear cheap.

Take time to do your own research. Buy fundamentally sound companies. Avoid the lure of penny stocks unless you can handle the risk. stocksguru wrote:Looking at my portfolio I feel it is time to divest from Eveready even though I still have confidence that it will be recovering soon, KQ and MSC are definitely good counters into the foreseeable future especially with their good dividend payouts. Don't cheat yourself. Eveready has no future. The likely future is that it will be delisted or suspended, or just stop trading like A Baumman, Orchads, Hutchings Biemer etc.

KQ is in a troubled industry and can not be relied on. Its ok to include KQ in your portfolio because it is trading at a discount to NAV but it must not be the star or captain of your team.

MSC is a good investment in my opinion but you need to know when to take profits. Buying low (below 5) and selling high (above 7) is a good idea. stocksguru wrote:I wish I had the emotional strength to sell Access at the current loss position but I do not so my only choice will be to do the thing I did with Eveready, average down. Access is selling at a discount of 0.9 P/BV. Price seems to have bottomed out or nearly there. there revenue side has held up despite the high competition in the industry. Once they sort out their finance costs they will be firmly in the profits. They did not ride the bull of 2012 and may turn out winners in 2013/14. The worst for this stock is almost over so i would hold out for 2 years or so.stocksguru wrote:What is more critical now that I have decided to sell off EVRD is where to put the proceeds;

1. Do I start averaging down ACCS?

2. Do I increase my position in MSC?

3. Do I increase my position in KQ?

4. Do I start diversification and add bonds to my portfolio?

I will deal with access in the second quarter of the year after the elections as well as the investment in bonds, so the only decision now is between 2 & 3. If you find yourself in a hole, stop digging. I know, this has been said before.

Buy truly strong stocks, trading at a discount. look at insurance, banks and some industrials.stocksguru wrote:In the current year I would like to add some fixed income instruments onto my portfolio so as to create a dependable income especially since I am getting closer to retirement.

Good idea. Seek professional assistance, since bonds also have risks. stocksguru wrote:Therefore it might make more sense to average down ACCS then sell off once it goes positive and use the funds to go into bonds instead of reinvesting in the equities market.

Buy proper stocks. WACHANA NA MIPANGO YA PENNY STOCKS.stocksguru wrote:With KRA on the neck of property owners, it seems time for me to sell off those rental units...

The requirement to pay tax on rental income is not new. Talk to your accountant or tax Advisor.

It is not hard to comply.

I came across the following tax page. The publisher has answered a number of my tax queries: http://www.facebook.com/...can-Tax/347356245279076

Life is short. Live passionately.

|

|

|

Rank: New-farer Joined: 11/12/2012 Posts: 92

|

@stocksguru,

you have given me an idea,I think it will be proper for me to share my trading style for the few years I have traded....and yes I'm net profitable, but I'm still learning.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

@Stocksguru....yes average down and Mumias and Access (esp election period)...then sell and get into energy, simiti and insurance, and u will not get disappointed. The best way to play the Real estate market is to sell the units as soon as they are done not to keep them, but since ur keeping them already, have a lease contract with your tenants and make sure that they will take care of the maintanance, that will ensure that you will not bear a heaavy burden when they move out. Keeping up with tenants is a hard task, may be you should contract a company to handle that for you, I knw of several people who do ths. Pole for the ordeal, happy 2013. "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Member Joined: 3/26/2012 Posts: 830

|

How about you change that name ''stocksguru'' until you truly deserve it  ...when an investor loses money,on one counter out of three,its understandable,two counters its a coincidence,three is a serious case.Do you read any financial statements from a company before you invest a cent?...secondly,it seems you may have started off with a large amount which is not good.I am 21,so automatically,my little money is an advantage because I lose little and gain important lessons. A successful man is not he who gets the best, it is he who makes the best from what he gets.

|

|

|

Rank: Elder Joined: 9/23/2009 Posts: 8,083 Location: Enk are Nyirobi

|

murchr wrote:@Stocksguru....yes average down and Mumias and Access (esp election period)...then sell and get into energy, simiti and insurance, and u will not get disappointed.

Why not get into energy, simiti and insurance with the new money now? Averaging down does not increase your profits. Averaging down only makes sense when dealing with bluechips and when there are no better alternatives out there. Otherwise it just becomes a case of throwing good money after bad. Life is short. Live passionately.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

sparkly wrote:murchr wrote:@Stocksguru....yes average down and Mumias and Access (esp election period)...then sell and get into energy, simiti and insurance, and u will not get disappointed.

Why not get into energy, simiti and insurance with the new money now? Averaging down does not increase your profits. Averaging down only makes sense when dealing with bluechips and when there are no better alternatives out there. Otherwise it just becomes a case of throwing good money after bad. Average to reducing the loss... he can as well get into them with new money. No problem "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Member Joined: 4/19/2007 Posts: 68

|

Thanks for the handful of information mkonomtupu wrote:@stocksguru my view is that if you are emotionally strong to sell, just hold the positions but you need to diversify into bonds as you approach retirement. On access...no need to average down on this one, when you are in a hole stop digging

KQ is airline stocks on that I will repeat what I said when KQ was a star stock on wazua in 2010 from Warren Buffet- airlines eat capital.

"If a capitalist had been present at Kitty Hawk back in the early 1900s, he should have shot Orville Wright. He would have saved his progeny money. But seriously, the airline business has been extraordinary. It has eaten up capital over the past century like almost no other business because people seem to keep coming back to it and putting fresh money in.

I have an 800 number now that I call if I get the urge to buy an airline stock. I call at 2 in the morning and I say: 'My name is Warren, and I'm an aeroholic.' And then they talk me down."

"How do you become a millionaire? Make a billion dollars and then buy an airline." -- Warren Buffett"

|

|

|

Rank: Member Joined: 4/19/2007 Posts: 68

|

I knew that if I persist long enough I will get a candid response from an active trader as the back bench commentators fall off. Thanks for the response, it is always encouraging when someone goes out of their way to give good free advise. This is something that we need to encourage and applaud. I shudder to think of what would happen to someone who took the advice I had been given initially to sell off my entire holding and then buy counters that have recently declared dividend but have not closed their books. The truth stings but it also gives one direction which is very different from criticism and cynicism. I have listened and will take action and hope that the story told by my portfolio in 2014 will be very different. sparkly wrote:Good for you to share your strategy on Wazua. You want us to give you candid feedback, right? We will and it will be painful to swallow but it will help you.stocksguru wrote:As the new year begins I am setting up a strategy for my portfolio which has gone off during the past 2 years. I get the impression that you don't do your own research. You just fall in love with a stock and rush to buy when you notice that it is falling, hoping that it will go back to the prior highs and you will make a killing. You also love penny stocks because they appear cheap.

Take time to do your own research. Buy fundamentally sound companies. Avoid the lure of penny stocks unless you can handle the risk. stocksguru wrote:Looking at my portfolio I feel it is time to divest from Eveready even though I still have confidence that it will be recovering soon, KQ and MSC are definitely good counters into the foreseeable future especially with their good dividend payouts. Don't cheat yourself. Eveready has no future. The likely future is that it will be delisted or suspended, or just stop trading like A Baumman, Orchads, Hutchings Biemer etc.

KQ is in a troubled industry and can not be relied on. Its ok to include KQ in your portfolio because it is trading at a discount to NAV but it must not be the star or captain of your team.

MSC is a good investment in my opinion but you need to know when to take profits. Buying low (below 5) and selling high (above 7) is a good idea. stocksguru wrote:I wish I had the emotional strength to sell Access at the current loss position but I do not so my only choice will be to do the thing I did with Eveready, average down. Access is selling at a discount of 0.9 P/BV. Price seems to have bottomed out or nearly there. there revenue side has held up despite the high competition in the industry. Once they sort out their finance costs they will be firmly in the profits. They did not ride the bull of 2012 and may turn out winners in 2013/14. The worst for this stock is almost over so i would hold out for 2 years or so.stocksguru wrote:What is more critical now that I have decided to sell off EVRD is where to put the proceeds;

1. Do I start averaging down ACCS?

2. Do I increase my position in MSC?

3. Do I increase my position in KQ?

4. Do I start diversification and add bonds to my portfolio?

I will deal with access in the second quarter of the year after the elections as well as the investment in bonds, so the only decision now is between 2 & 3. If you find yourself in a hole, stop digging. I know, this has been said before.

Buy truly strong stocks, trading at a discount. look at insurance, banks and some industrials.stocksguru wrote:In the current year I would like to add some fixed income instruments onto my portfolio so as to create a dependable income especially since I am getting closer to retirement.

Good idea. Seek professional assistance, since bonds also have risks. stocksguru wrote:Therefore it might make more sense to average down ACCS then sell off once it goes positive and use the funds to go into bonds instead of reinvesting in the equities market.

Buy proper stocks. WACHANA NA MIPANGO YA PENNY STOCKS.stocksguru wrote:With KRA on the neck of property owners, it seems time for me to sell off those rental units...

The requirement to pay tax on rental income is not new. Talk to your accountant or tax Advisor.

It is not hard to comply.

I came across the following tax page. The publisher has answered a number of my tax queries: http://www.facebook.com/...can-Tax/347356245279076

|

|

|

Rank: Member Joined: 4/19/2007 Posts: 68

|

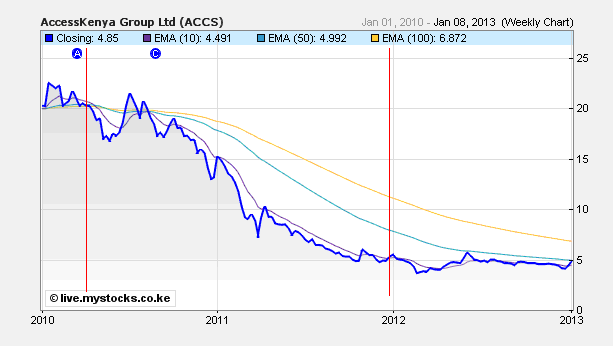

In retrospect, everyone is a genius, when I was taking a position on the various counters all the indicators and fundamentals where right for entry.   The first red line on the left indicates when I started buying the particular share and the second one when I stopped increasing my position. I am sure that many of you out there have the same shares in your portfolios but are too ashamed to say so, if you made the decision why not be proud enough to stand by it? Looking forward to continued positive responses

|

|

|

Rank: Member Joined: 3/26/2012 Posts: 830

|

stocksguru wrote:In retrospect, everyone is a genius, when I was taking a position on the various counters all the indicators and fundamentals where right for entry... The greatest laggard I have is Sasini which I bought at 11.2 and today trades at 12.10....i will dump just before books closure. #everyone has his skeleton in the closet# A successful man is not he who gets the best, it is he who makes the best from what he gets.

|

|

|

Wazua

»

Investor

»

Stocks

»

New Year Resolutions

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|