Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

HSBC and Standard Chartered to pay US over $2bn in charges - https://rt.com/business/...ndard-charter-fine-797/

Quote:British banking giants have come under fire line from the US financial authorities. HSBC will pay a record $1.9bn to settle a money-laundering probe, with Standard Chartered getting a $327mn charge for violating US sanctions against Iran.

The fine against HSBC will include $1.25bn in forfeiture, as well as $655mn in civil penalties. In an attempt to cut costs and improve profitability, HSBC CEO Stuart Gulliver made the bank the matter for US probes and claims from UK clients. The lack of money-laundering controls at HSBC allowed terrorists and drug cartels access to the US financial system, according to Bloomberg.

The bank accepts responsibility for “past mistakes” and is “profoundly sorry for them,” Gulliver said. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

"Like an improvident spendthrift, whose pressing occasions will not allow him to wait for the regular payment of his revenue, the state is in the constant practice of borrowing of its own factors and agents, and of paying interest for the use of its own money." Smith, Adam. Wealth of Nations. 1776. World debt comparison. The global debt clock. An interactive overview of government debt across the planet: http://www.economist.com...ntent/global_debt_clock

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Foregoing meals to buy airtime!? http://www.standardmedia...ng-meals-to-buy-airtime

There has to be a way out of this quagmire - mobile telephony is now a basic need... Then GoK taxes mobile money?! - http://www.businessdaily...66/-/em5qae/-/index.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Assange to run for Australian Senate, start Wikileaks party - http://bit.ly/SWNSgJ

Quote:Wikileaks founder Julian Assange says he intends to run for a seat in the Australian Senate in next year’s federal election and will announce the formation of a WikiLeaks party. He made the announcement from the Ecuadorian embassy in London.

Assange has been living in the embassy for the past six months, in an effort to avoid extradition to Sweden and possibly the US.

The whistleblower told Fairfax Media that plans to register the political party were “significantly advanced” and added that “a number of very worthy people admired by the Australian public” have expressed their availability to run for election on the party ticket. This will be interesting. A fugitive forming a party and running for a senate position. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Standard Bank to sell China's ICBC 60% of 2 UK trading units - http://www.reuters.com/a...k-idUSL5E8ND4D220121213

At this rate Standard bank SA will become ICBC SA... Are we soon to see ICBC in EA where Standard Bank has a presence... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Japanese operator in most frank admission over nuclear disaster - http://reut.rs/TZfkem

Quote:The operator of a Japanese nuclear power plant that blew up after a tsunami last year said on Friday its lack of safety and bad habits were behind the world's worst nuclear accident in 25 years, its most forthright admission of culpability.

The operator, Tokyo Electric Power Co, said it accepted the findings of a parliamentary inquiry into the Fukushima nuclear disaster that accused the company of "collusion" with industry regulators. 643 days later TEPCO confesses and it is damning as it gets... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

youcan'tstopusnow wrote:One of Kenya’s mid-sized lenders, Dubai Bank, is facing a credibility storm after a former managing director made shocking revelations, detailing a web of irregular transactions that have put close to Sh2 billion in customer deposits at risk. Ms Said has filed in court numerous documents alleging irregular transactions by Mr Zubeidi. The documents show that the banking sector regulator, the CBK was made aware of the suspect dealings at the bank but no action has since been taken. Ms Said also says in an affidavit filed in court that Mr Zubeidi boasted to have the protection of senior CBK and Criminal Investigations Department (CID) officials making him untouchable. CBK governor, Njuguna Ndung’u, said the regulator had received the allegations by Ms Said in two letters dated November 23 and 29. http://www.businessdaily.../-/uq4repz/-/index.html

Funny I just posted about rogue banks jana... The saga continues... http://www.businessdaily...6/-/vn3834/-/index.html

GOD BLESS YOUR LIFE

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

More gold in Kenya? http://www.standardmedia...ves-found-in-Trans-Mara given tis substandard, we have to wait for more confirmation from other sources "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Quote stuffing - Unbelievable that Credit Suisse admits that it is not a conspiracy theory as markets get rigged & raided everyday by HFT bots. This will open an interesting pandora's box for international prop trading desks who vehemently defend their HFT strategies with the support of market regulators. So now we know of gold/silver manipulation and now HFT predators. Great swimming in this ocean now knowing where the shark tanks are located  http://www.nanex.net/aqck2/4022.html http://www.nanex.net/aqck2/4022.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:HSBC and Standard Chartered to pay US over $2bn in charges - https://rt.com/business/...ndard-charter-fine-797/

Quote:British banking giants have come under fire line from the US financial authorities. HSBC will pay a record $1.9bn to settle a money-laundering probe, with Standard Chartered getting a $327mn charge for violating US sanctions against Iran.

The fine against HSBC will include $1.25bn in forfeiture, as well as $655mn in civil penalties. In an attempt to cut costs and improve profitability, HSBC CEO Stuart Gulliver made the bank the matter for US probes and claims from UK clients. The lack of money-laundering controls at HSBC allowed terrorists and drug cartels access to the US financial system, according to Bloomberg.

The bank accepts responsibility for “past mistakes” and is “profoundly sorry for them,” Gulliver said. From a different perspective - www.rollingstone.com/pol...g-war-is-a-joke-20121213

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

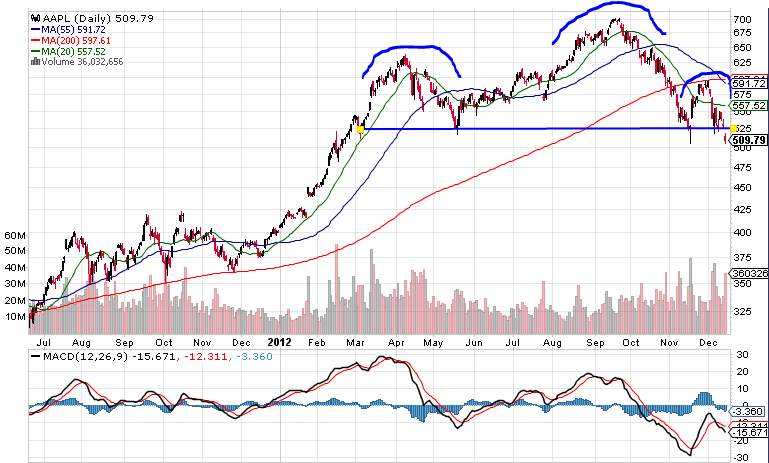

Eh, this H&S pattern is currently playing out on the Apple stock. Unless some drastic announcement is made to make it turn bullish, the cliff jump will happen all the way down to $425-450 gap up zone. Image courtesy of Seekingalpha.com  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

youcan'tstopusnow wrote:youcan'tstopusnow wrote:One of Kenya’s mid-sized lenders, Dubai Bank, is facing a credibility storm after a former managing director made shocking revelations, detailing a web of irregular transactions that have put close to Sh2 billion in customer deposits at risk. Ms Said has filed in court numerous documents alleging irregular transactions by Mr Zubeidi. The documents show that the banking sector regulator, the CBK was made aware of the suspect dealings at the bank but no action has since been taken. Ms Said also says in an affidavit filed in court that Mr Zubeidi boasted to have the protection of senior CBK and Criminal Investigations Department (CID) officials making him untouchable. CBK governor, Njuguna Ndung’u, said the regulator had received the allegations by Ms Said in two letters dated November 23 and 29. http://www.businessdaily.../-/uq4repz/-/index.html

Funny I just posted about rogue banks jana... The saga continues... http://www.businessdaily...6/-/vn3834/-/index.html

Kwani hii ni Afrocinema drama? Ex MD claiming police are trailing her http://www.businessdaily.../-/ehn8hoz/-/index.html

She clearly rubbed the wrong people... GOD BLESS YOUR LIFE

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

The rich in heavily indebted countries are as prized as rhino horns, targeted with increasing zeal by government workers to pay off the interest, interest on interest, interest on interest on interest and so on of sovereign debt. A new class is emerging of Tax Refugees, willing to give up their citizenship for tax havens. "A tax crackdown by the United States has sent more than one million Americans and green-card holders living in Canada scrambling to figure out how to comply. The move is part of a push by the U.S. Internal Revenue Service (IRS) to make sure U.S. taxpayers are paying what they owe on foreign accounts. Unlike most countries, the U.S. requires its citizens to file annual tax returns based on their worldwide income, regardless of where they live...." Read more: http://www.theglobeandma...esidents/article584297/

France's Socialist leanings are driving the wealthy overseas. Belgium or Bust. One wonders what will happen when the rich vacate or get creative with tax declaration. Will the definition of "rich" get a downward adjustment? "FRANCE'S leading actor, Gerard Depardieu, says he is giving up his French passport after the prime minister called him "pathetic" for seeking to avoid taxes by moving to Belgium. In an open letter to Prime Minister Jean-Marc Ayrault, the 63-year-old Cyrano de Bergerac and Green Card film star said he had been treated unfairly after years of supporting France and paying millions of euros in taxes...." Read more: http://www.theaustralian...-e6frg6so-1226538072852

Nowhere to run, not even once safe-haven Switzerland. "The German upper house of parliament, dominated by opposition parties, has rejected a tax treaty aimed at legalising undeclared assets held by Germans in Swiss banks. The accord is set to fail if no compromise is found next month.... The accord would impose a retroactive levy of up to 41 per cent on capital in offshore bank accounts held by foreign citizens, impose a tax on future interest income and allow the account holders to remain anonymous..." Read more: http://www.swissinfo.ch/..._deal.html?cid=34023936

A FUBAR situation is in formation. Western governments are in austerity mode while they should have been spending to make up for the declining private sector spending. Hunting down the holders of wealth and investors only serves to worsen the situation, creating a downward spiral in private sector spending. Lack of private sector spending or capital flight reduces employment and economic growth, without which the government lacks the taxes to pay its workers and maintain the perks of civilisation (security, infrastructure, social security etc). Laying off government workers while cutting spending only serves to fray the fabric that holds society together sparking off protests, strikes and demonstrations. The private sector will not be attracted to a country whose workers are an ever-present menace on the streets and cannot be depended on to clock the number of working hours expected. And so the downward spiral continues.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@KK - Are you seeing the tax refugee pattern unfolding hard towards 2014 as more multinationals abandon their home nations? I'm currently looking at the flows into this silicon savannah ideology. The likes of IBM, Google and other tech heavyweights are not only pissed by the tax on high tax of their broke home govts, but also the restrictions being imposed on tech explosion like the PIPA laws etc. I expect many to shift their funds anywhere the tax laws are not so hostile and environment to innovate as well as profit is not so much restricted. The so call 3rd world nations stand to benefit the most during this wealth transfer (capital flight) since their economies are still at the rock bottom stage. Only good governance stands in the way of this daring capital flight in those nations, but politics is improving there. This will be an interesting shift between now and 2050. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Gulf states face hard economic truth about subsidies Kuwait's electricity rates are so negligible that people often do not even bother to pay. And there are no repercussions. The state simply picks up the tab. The IMF has said that Kuwait will have exhausted all its savings by 2017, if it keeps on spending money at the current rate. http://www.bbc.co.uk/new...ld-middle-east-20644964

GOD BLESS YOUR LIFE

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

hisah wrote:@KK - Are you seeing the tax refugee pattern unfolding hard towards 2014 as more multinationals abandon their home nations? I'm currently looking at the flows into this silicon savannah ideology. The likes of IBM, Google and other tech heavyweights are not only pissed by the tax on high tax of their broke home govts, but also the restrictions being imposed on tech explosion like the PIPA laws etc. I expect many to shift their funds anywhere the tax laws are not so hostile and environment to innovate as well as profit is not so much restricted. The so call 3rd world nations stand to benefit the most during this wealth transfer (capital flight) since their economies are still at the rock bottom stage. Only good governance stands in the way of this daring capital flight in those nations, but politics is improving there. This will be an interesting shift between now and 2050. @Hisah. The U.S. is repeating the Marxist/Facist errors of the 1940's which saw the tax rate on the top income bracket clock 94%. At the time, it had grabbed the mantle of financial capital of the world from Great Britain as well as holding 76% of the world's gold reserves. Other feathers in its cap were that it had remained largely unscathed by World War II and was the largest creditor nation. It thus, could get away with it. Present day is a different kettle of fish. The infamous Boston Tea Party of 1773 was a tax revolt against England's taxation of American colonies to fund the war with France. In 1765, England had began a series of taxes that culminated in the Tea Act of 1773 with was a tax on Tea. The American Revolutionary War erupted in 1775 leading to Independence. France is replaying the class warfare of the 18th Century post-Mississippi Bubble that led to the raiding of the Bastille in 1789 and the beginning of the French Revolution. You are right in your assertion. Rule of Law is the first consideration of a migrating multi-national. Availability of skilled labour, labour cost, taxation policy etc are also important considerations. Interestingly, the McKinsey Report titled "Lions on the Move: The Progress and Potential of African Economies" provides an insightful chart on capital inflows on pg. 54. Note that the low in Foreign Direct Investment was in 1990. The major high was in 2007 marking a 17 year bull market. Although not on the chart, 2011 was significant as the beginning of the European Debt Crisis. Going forward, 2016 is standing out as a major turning point due perhaps to the Debt Crisis landing fairly and squarely on the shores of the United States.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

RIM and Netflix Dropped From Nasdaq 100 Index - http://www.huffingtonpos...sdaq-100_n_2313336.html Probably we have seen the last of blackberry phones as the online pay video stream biz also takes a nosedive to soon kill off Netflix. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Secret Libor Transcripts Expose Trader Rate-Manipulation - http://www.bloomberg.com...law-of-light-touch.html

Quote:For years, traders at RBS, Barclays Plc, UBS AG, Deutsche Bank AG, Rabobank Grp and other firms that stood to profit worked with employees responsible for setting the benchmark to rig the price of money, according to documents obtained by Bloomberg and interviews with two dozen current and former traders, lawyers and regulators. Those interviews reveal how the manipulation flourished for years, even after bank supervisors were made aware of the system’s flaws. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

The China Daily dated 24th of October, 2012 reported the formation of a Renminbi bloc in East Asia amongst seven of the ten economies to peg their currencies to the Yuan, and de-couple from the U.S. Dollar. The spirit of the move underlines the unease with the U.S. Fiscal Management which has the potential of being transmitted into the reserve currency of the world - the U.S. Dollar. Wrangles and brinkmanship marked the August 2011 debate on the debt ceiling. Now we know that was the first Scene of what seems to be many Acts marking the superpower's descend from its citadel. From a cyclical perspective, 5th of January, 2013 stands out as a turning point.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Italy PM expected to resign today - http://reut.rs/Ud6OYt

Quote:Monti, who this month lost the support of the center-right People of Freedom (PDL) party which had backed his technocrat government in parliament, had already announced he would stand down as soon as the budget was passed.

He is due to hold a news conference on Sunday at which he is expected to say whether he intends to stand as a candidate in the election, likely to be held on February 24. Getting hot in Italia... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|