Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Rank: Elder Joined: 12/4/2009 Posts: 10,798 Location: NAIROBI

|

Where is the price list for today.NSE website still reads price list for Friday 19 October Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

The nse was up 19.72 pts to close at 4,053.79 "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

CIC was at 3.50 jana. So close to dipping below the listing price... GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

EABL has moved 1.4M shares, turnover of 337M... How will the locals compete with this hot money supporting the bluechips this yr? $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

youcan'tstopusnow wrote:CIC was at 3.50 jana. So close to dipping below the listing price... Let's see if PPT will hold back the plunge-gates...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Aguytrying wrote:hisah wrote:Aguytrying wrote:surely with the index performing so well this year, we can't expect it to perform nearly as well next year because of the high base created this year. a slower growth next year, then the next it can grow at higher rate in 2014. unless we are/will be in a full on bull , i don't see back to back 20% percent index gains Check Venezuela & Mongolia back to back bulls... Hot money never observes the commoners laws!? will do Mongolia - The IMF expects 17% growth over 2011-2012 and 12% in 2013, which would uniquely put Mongolia in the top-three globally for global growth for each year of 2011-2013. The mining boom is responsible for this. June elections do concern the market – but on the macro side, at least we are reassured by automatic fiscal constraints coming in 2013.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Read pg 74 to see a summary of KE Q1 2012 economy analysis by Renaissance Capital - https://t.co/P4HBQZvb

Quote: C/A is not out of the woods

The strong growth in import demand, partly driven by credit, explains the deterioration of the C/A in 2011. We expected a slowdown in credit growth, owing to tight monetary policy, to help temper import demand. However, the C/A deficit widened in 1Q12 owing to strengthening import demand, following signs of a slowdown in 4Q11, and weak export performance. The stronger imports can be attributed to a 16% YoY increase in the oil price and strong capital equipment and machinery imports, largely due to ongoing infrastructure projects. Kenya’s largest export, tea, which generates one-fifth of export earnings, was undermined by frost, which reduced output by 20%. An added risk to the C/A is subdued tourism receipts and horticulture earnings, owing to economic weakness in the EU, the biggest market for these exports. All these headwinds affirm our view that the shilling is too strong at KES83/$1 given the fundamentals, and is likely to weaken to KES85-90/$1 before stabilising. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

hisah wrote:Aguytrying wrote:hisah wrote:Aguytrying wrote:surely with the index performing so well this year, we can't expect it to perform nearly as well next year because of the high base created this year. a slower growth next year, then the next it can grow at higher rate in 2014. unless we are/will be in a full on bull , i don't see back to back 20% percent index gains Check Venezuela & Mongolia back to back bulls... Hot money never observes the commoners laws!? will do Mongolia - The IMF expects 17% growth over 2011-2012 and 12% in 2013, which would uniquely put Mongolia in the top-three globally for global growth for each year of 2011-2013. The mining boom is responsible for this. June elections do concern the market – but on the macro side, at least we are reassured by automatic fiscal constraints coming in 2013. Wow. The sky is the limit if the bull starts charging The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:youcan'tstopusnow wrote:CIC was at 3.50 jana. So close to dipping below the listing price... Let's see if PPT will hold back the plunge-gates... CIC trades sub 3.50/- current trades @3.45/- VWAP still @3.50/-

Interesting action here...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

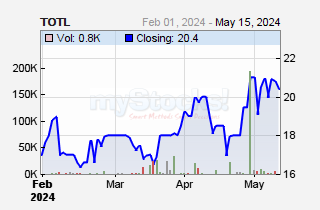

Total looks like it wants to test the 2012 low @13.00/-  If it closes as it is Total will be @14.20/- while KK will be @14.15/- Value hunters will be interested with this coincidence... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

hisah wrote:hisah wrote:youcan'tstopusnow wrote:CIC was at 3.50 jana. So close to dipping below the listing price... Let's see if PPT will hold back the plunge-gates... CIC trades sub 3.50/- current trades @3.45/- VWAP still @3.50/-

Interesting action here... Did I see a High of 3.70. The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

jerry wrote:hisah wrote:hisah wrote:youcan'tstopusnow wrote:CIC was at 3.50 jana. So close to dipping below the listing price... Let's see if PPT will hold back the plunge-gates... CIC trades sub 3.50/- current trades @3.45/- VWAP still @3.50/-

Interesting action here... Did I see a High of 3.70. Yes, 3.70 was the high and 3.45 was the low. Avg is 3.50/- with the supply overhang diminishing (few sellers - selling fatigue approaching).$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

BAT and EABL still red hot then KCB. Somehow shares of equity one of the big 4 banks has refused to take off... Very strange for this blue chip... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,798 Location: NAIROBI

|

KCB has overtaken Equity Bank in terms of market capitalisation to become number 3 in market cap after EABL and Safaricom Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: New-farer Joined: 8/7/2012 Posts: 39

|

Did anyone else notice the big jump of Barbeque (BBK)? It has been hovering at around 14.10-14.40 in the last few weeks and then it has suddenly made the leap to 15.50 in 2 days. Is this due to the awaited merger or just the bullish sentiments prevailing?

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

Turnover declined to KSh.600M from the previous session’s KSh.648M, the number of shares

traded stood at 22M against 17M posted yesterday.

The NSE 20 Share Index was up 22.76 points to settle at 4095.26.

All Share Index (NASI) was up 0.50 points to stand at 90.28.

FTSE NSE Kenya 15 Index was up 0.89 points to stand at 121.07.

FTSE NSE Kenya 25 Index was up 0.92 points to stand at 123.73.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

So far NSE20 has surprised by leaping 4000 and still steaming through the resistance layers. The major solid barrier is 4400. This will have to wait till post election since kuna sellers wengi sana and profits have to be taken after blue chip counters have flipped more than 50% and some going into 100%... Bulls should run out of steam from 4200pts. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: New-farer Joined: 8/7/2012 Posts: 39

|

Now if only Centum, MSC and AK could follow the trend all my counters would go green but I am not really hopeful for these two. For all my my counters to go green I'd need Centum to hit 20 bob, MSC to hit 10 and AK to hit 25. That's a tad too optimistic I think! I don't think investors are of the view that Centum and AK are doing enough to make them wealthy. Anyway we'll wait and see...

|

|

|

Rank: Elder Joined: 12/4/2009 Posts: 10,798 Location: NAIROBI

|

True Kanjora1 Centum,Access and Mumias prospects are dim. Centum could have been on a rebound if they hadn't reduced their portfolio in the NSE. The decision to go to real estate was a big blunder. Wealth is built through a relatively simple equation

Wealth=Income + Investments - Lifestyle

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,194 Location: nairobi

|

For a.k to hit 25bob,may be a buyout...qw's stock "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Wazua

»

Investor

»

Stocks

»

How to tell NSE has bottomed out

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|