Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

Nabwire wrote:But JP Morgan, how can the share be up almost 6% yet their trading losses estimates were found to be double what they initially reported...LOL!! Gotta love the bank hustle. When Jamie Diamond reported the $2bn loss he indicated that losses could extend further upon review of all the trades.. Frankly the market was anticipating total trading losses of $7-8bn after unfolding.. So the $5.8bn loss must come as good news.. Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

guru267 wrote:Nabwire wrote:But JP Morgan, how can the share be up almost 6% yet their trading losses estimates were found to be double what they initially reported...LOL!! Gotta love the bank hustle. When Jamie Diamond reported the $2bn loss he indicated that losses could extend further upon review of all the trades.. Frankly the market was anticipating total trading losses of $7-8bn after unfolding.. So the $5.8bn loss must come as good news.. Good to know! I still wouldnt touch it  we are talking Billions here

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

I just noticed that Paul Krugman is on that periodic table!! This blanket hate for Wallstreet is not good, now what did Krugman do? And how come the most hated man in biz is not on that list? Or is Lloyd Blankfein Golum? LOL I bet you anything they dont give two whats about what people think of them. I'd rather be a hated Billionaire than a loved pauper, why lie! I guess Munger pic is Charlie Munger...LOL and for Alan Greespan they just put moron...hahaha. Cramer as derangium is true why lie, he knows his stuff but after watching him your head spins so much. Fecal matter...LOL

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

What’s Iran doing with Turkish gold? http://blogs.ft.com/beyo...?catid=491#axzz20AUtuBeI$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

LIBOR drama still unfolding  http://news.sky.com/stor...implicates-libor-rivals http://news.sky.com/stor...implicates-libor-rivals

Quote:"The macro-environment remains febrile, especially in Europe. We have to remain vigilant on balance sheet exposures and risk management. In short, our focus must remain on capital, funding and liquidity; improving returns; and driving income growth."

The memo, co-written by Marcus Agius, Barclays' outgoing chairman, apologised for the impact of the rate-fixing episode on the bank's staff, but hinted that its rivals were likely to be hit even harder than the £290m in fines imposed on Barclays. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

US M2 supply totally crimped?!  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

European bond yields still on a negative yield bonanza... That is bond investors are willing to pay euro gubberments to stash their money in those bonds!? http://online.wsj.com/ar...577520480011435426.html

I dont get it? Africa gubberment bonds are positive and some double digit yields. Why take negative yields?! Yawa! $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Libor scandal forces barclays bank out of UAE rate panel. The fallout is accelerating. What happens to the rest who are still in hiding waiting bigger fines soon... Could barclays become the lehman for europe... www.reuters.com/article/...E86E03N20120715?irpc=932$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

hisah wrote:European bond yields still on a negative yield bonanza... That is bond investors are willing to pay euro gubberments to stash their money in those bonds!? http://online.wsj.com/ar...577520480011435426.html

I dont get it? Africa gubberment bonds are positive and some double digit yields. Why take negative yields?! Yawa! hisah, hiyo ndio inaitwa ujinga! And why not just put the money under the mattress  GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Could Africa-style debt relief be the answer to euro woes? Many Greeks, battered by austerity, would look with envy at some African countries that had their crippling debts cancelled in the latter part of the 1990s to allow them a fresh start. The Heavily Indebted Poor Countries (HIPC) Initiative was the first international response to provide comprehensive debt relief to the world's poorest, most heavily-indebted countries. http://www.bbc.co.uk/news/business-18785856

GOD BLESS YOUR LIFE

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

hisah wrote:European bond yields still on a negative yield bonanza... That is bond investors are willing to pay euro gubberments to stash their money in those bonds!? http://online.wsj.com/ar...577520480011435426.html

I dont get it? Africa gubberment bonds are positive and some double digit yields. Why take negative yields?! Yawa! Patriotism  "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

murchr wrote:hisah wrote:European bond yields still on a negative yield bonanza... That is bond investors are willing to pay euro gubberments to stash their money in those bonds!? http://online.wsj.com/ar...577520480011435426.html

I dont get it? Africa gubberment bonds are positive and some double digit yields. Why take negative yields?! Yawa! Patriotism  How are their pension scheme making money holding these bonds? Wananchi will riot soon!$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 7/22/2011 Posts: 1,325

|

A wise man changes his mind sometimes a fool never. Time to restrategize, hope for the best but plan for the worst. http://finance.yahoo.com...ope-says-155504860.html

I wonder if energy stocks will be a good enough hedge

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

HSBC used by 'drug kingpins', says US Senate http://www.bbc.co.uk/news/business-18867054

GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Energy stocks could bleed, but that would be a lovely discount especially for those involved in EA petro play.

Men, I get goosebumps when Peter Schiff starts making those calls. He's always ahead of the curve and things have a way of unraveling suddenly. Back in 2006/2007 he was featured in a number of lamestream media biz shows, so that they could ridicule him. They started again in 2011. I don't like the pattern now that we have a ticking euroland debt bomb...

https://www.youtube.com/watch?v=s_z5dZbgTDM

https://www.youtube.com/...VNI&feature=related

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Now Japan wants to join the negative bond yields bonanza... Deflation aka deleveraging is making money masters go crazy! BOJ Opens Door to Negative Rates by Ending Yield Floor - http://www.bloomberg.com...yield-floor-economy.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

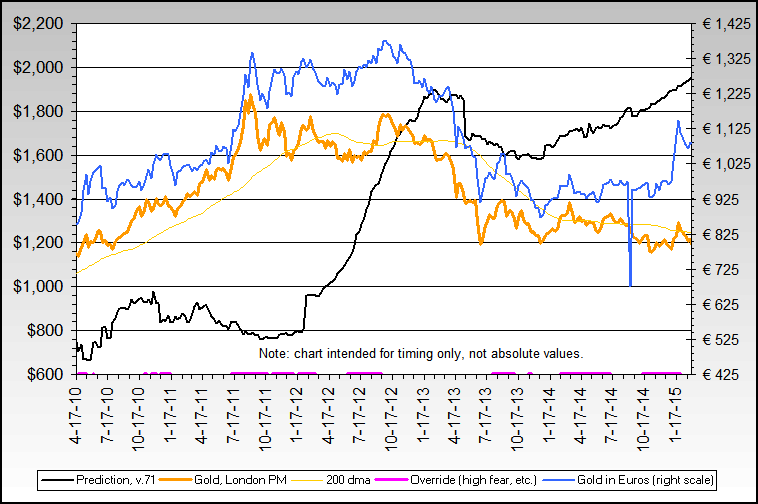

Gold is pending a major break priced in euros... Graph courtesy of nowandfutures.com  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Microsoft may report first quarterly loss in 20 years - http://www.cbsnews.com/video/watch/?id=7413738n

http://timesleader.com/s...rosofts-fiscal-4Q,177787$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Libor scandal: Ben Bernanke says system flawed - http://www.bbc.co.uk/news/business-18873944

Quote:The Libor system, which sets inter-bank lending rates, is "structurally flawed", the chairman of the US central bank has said. It takes a lot of guts for a bankster to admit this sh**... Libor scandal: Central bankers, regulators to hold talks on scrapping - http://economictimes.ind...rticleshow/15040559.cms

Quote:Democratic senator Robert Menendez said the Libor scandal represented the "culture of greed and lying" in the banking world. Quote:Mr Bernanke also called for action to address the massive tax rises and spending cuts looming in the US. If these were not changed, the US could fall into recession, he said.

At the end of 2012 tax cuts brought in by the George W Bush administration are due to expire and $1.2 trillion (£770bn) in automatic spending cuts will take effect.

Central bank chairman Ben Bernanke told US senators that the fiscal cliff, as it is known, needed to be tackled "sooner rather than later". $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 10/11/2006 Posts: 2,304

|

Massive Wealth destruction ComingAnother name for Deflation. Conventional thinkers waste time building shelters when they are unnecessary and then have no shelters when they need them the most. Socionomists do the opposite.

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|