Wazua

»

Investor

»

Stocks

»

coop bank Q1 2012 results

Rank: Member Joined: 2/22/2010 Posts: 510 Location: De egg

|

@Jerry how does a bonus issue raise cash for a company . Peace be with you

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

jerry wrote:Mastermind wrote:... Btw what happened to the rights issues? Probably bonus will raise enough cash. @jerry bonus issues do not raise any cash.. @mastermind the rights issue will most likely be in 2013 after the macroeconomic dust has completely settled.. The bonus issue is to enable shareholders to compete with the bond/bill yields without giving too much cash.. Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

... and also open 30 new branches in kenya in 2012 Capital call is coming soon!!!

|

|

|

Rank: Veteran Joined: 1/20/2011 Posts: 1,820 Location: Nakuru

|

, Dumb money becomes dumb only when it listens to smart money

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

Detailed analysis of the Coop Bank Q1 2012 earnings on this link http://www.contrarianinv...few-greenshoots-but-dull

|

|

|

Rank: Member Joined: 2/8/2007 Posts: 808

|

Opening additional branches this year would amount to a massive gamble for Co-op;- fraught with significant downside.

What co-op needs now, is to rationalize and consolidate what they have got and add efficiency. KCB are at it, Equity are deep in that channel. Co-op must believe that there isn't too many unbanked customers out there at the moment and reaching the few remaining out there will involve more tact and brain (alternative channels & technology) than brawn (concrete branches). In other words, opening branches from now on, will be have to be very opportunistic rather than a hit and miss operation.

Co-op is trailing peers (KCB & Equity) on most metrics and opening branches will diminish the only metric they seem to be competitive in which is cost to income.

Their branch expansion strategy hasn't worked since Jan 2011, and by now it should be obvious to management, they need to spend a bit more time critiqing the numbers and evaluating which between strategy and environment is undermining performance as opposed to pushing all out. Deposits only grew at 2.3% from Q4 of 2011 to Q1 of 2012, whereas from since Q1 2011 to Q1 of 2012 only 7.3%. If you consider cost of deposits has gone up from 1.7% in Q1 -2011 to 6.6 in Q1 - 2012 it's obvious co-op went has been out aggressively buying deposits which is not what you want to do when you are 30++ branches bank. The logic of cheap deposits falls off. Equity Bank's cost of deposits moved from 1.1% to 3.3% during the same period and with 29% growth in deposits. KCB's cost of depos moved from 1.0% to 4.3% during the same period while deposits grew by 24.3% again both easily reeling in transaction based deposits. Co-ops deposits are 146B, Equity's 151B and KCB's 260B. Co-op's loans only grew by 3.8% from Q4 of 2011 to Q1 of 2011. KCB's loan book shrank by (1.7%) and Equity's grew by 6.4% during the same period. Equity and KCB have larger loan books. Effectively the credit markets are in comatose at the moment. I also don't see the CBR dropping over the next 2 months. So the question is what's the rationale of Co-op 30 new branches this year? I don't see the opportunity cost for Co-op NOT opening branches this year!

|

|

|

Rank: Veteran Joined: 1/20/2011 Posts: 1,820 Location: Nakuru

|

bottom line is that coop fundamentals remain strong Dumb money becomes dumb only when it listens to smart money

|

|

|

Rank: Member Joined: 2/8/2007 Posts: 808

|

@fyatu,

What do you define fundamentals as, branches or buildings??????I can't seem to see the fundamentals you refer to....

|

|

|

Rank: Veteran Joined: 1/20/2011 Posts: 1,820 Location: Nakuru

|

The simple fact that a profit was made.......I'm looking at it as my small duka in the village Dumb money becomes dumb only when it listens to smart money

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Co-op Bank’s 1Q12 EPS up 19.2% y/y, strong recovery q/q. Co-operative Bank of Kenya (Co-op)released 1Q12 performance figures for the period ended March, marking 19.2% y/y growth in EPS to KES 0.47. Recovering from a poor run in 3Q11 & 4Q11 (25.7% & 34.2% q/q decline in EPS) 1Q12 EPS was up 140.2% q/q (NIR up 83.2% q/q recovering from realized loss on sale of AFS instruments). Riding on FY11’s strong growth in SME and personal unsecured loan books, NIM was up 150bp y/y & 110bp q/q. Surprisingly, total operating costs declined 10.3% q/q on the back of fall in other operating expenses. Loan loss provision was up 25% y/y (+18.5% q/q). Being the first bank to show strain in NPL’s, NPL ratio rose to 4.2% in 1Q12 from 3.8% in 4Q11. Balance sheet performance q/q (+3.8% loans & +2.3% deposits) outperformed KCB’s but underperformed Equity’s. Given market, brand and product positioning, Equity and KCB are Co-op’s two main competitors. Based on our forecasts, Equity will continue outperforming both Co-op and KCB on RoaA & RoaE, while KCB will outperform both Co-op & Equity on dividend payout and possibly dividend yield. Seeing better value in KCB & Equity and after factoring the planned 1 for 5 bonus issue we retain our HOLD recommendation on Co-op Bank . ](Fair Value KES 12.42, 12.2% below current share price). Currently, Co-op is trading cum-dividend (final DPS KES 0.40; book closure 28 May). We retain our FY12 EPS forecast of KES 1.54 (+20.6% y/y).

c/p _ sib

|

|

|

Rank: Veteran Joined: 1/20/2011 Posts: 1,820 Location: Nakuru

|

[quote=the deal]Detailed analysis of the Coop Bank Q1 2012 earnings on this link http://www.contrarianinv...ew-greenshoots-but-dull[/quote] when will the extra shares start trading?? Dumb money becomes dumb only when it listens to smart money

|

|

|

Rank: Elder Joined: 6/20/2012 Posts: 3,855 Location: Othumo

|

Thought they are already in MY CDS account on Wednesday last week, they must be trading now Thieves

|

|

|

Rank: Elder Joined: 7/21/2010 Posts: 6,192 Location: nairobi

|

I also got mine but am not selling.the price dip is because of the new shares not books close as at now. "Don't let the fear of losing be greater than the excitement of winning."

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

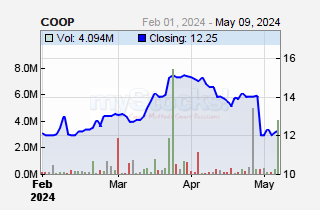

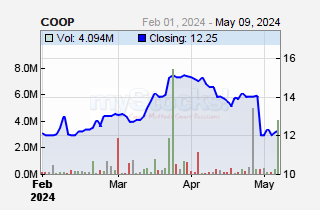

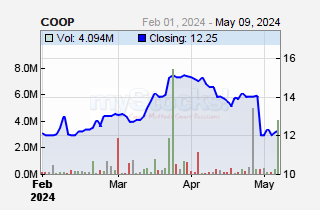

Everytime this counter hits 11s price zone, the volumes pick up. What is the message  CFC behaves the same @40 or below as well as KCB @15 and member @16... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 6/20/2012 Posts: 3,855 Location: Othumo

|

hisah wrote: Everytime this counter hits 11s price zone, the volumes pick up. What is the message  CFC behaves the same @40 or below as well as KCB @15 and member @16... Using fundamentals, what is the best price to acquire more of this thing; my current average is Kshs. 9.30 and i want to add more Thieves

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

hisah wrote: Everytime this counter hits 11s price zone, the volumes pick up. What is the message  CFC behaves the same @40 or below as well as KCB @15 and member @16... This time round, the drop from KES 14 to KES 11.20 is because of the 20% dilution emanating from the 1:5 bonus issue. Notice book closure for the bonus issue was 15th June

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

King G wrote:

Using fundamentals, what is the best price to acquire more of this thing; my current average is Kshs. 9.30 and i want to add more

Before the bonus issue, SIB gave coop a fair value of KES 12.42. With the 20% dilution, the fair value now comes to KES 9.94. That should give us a trailing PER of 7.76 (9.94/1.28)

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Anyone wanting a piece of co-op, now would be the best time. Look at the volumes around this region, numbers dont lie. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

Coop Bank Fair Value Kes12 based on a projected eps of Ke1.7 and a forward pe of 7 which I think will be hard to match given current market conditions Link http://www.contrarianinv...ew-greenshoots-but-dull

So if you looking for value go for KCB, Member, BBK...SBK etc...Coop appears to be fully priced thus lack of interest from foreigners!

|

|

|

Rank: Elder Joined: 6/20/2012 Posts: 3,855 Location: Othumo

|

mwekez@ji wrote:King G wrote:

Using fundamentals, what is the best price to acquire more of this thing; my current average is Kshs. 9.30 and i want to add more

Before the bonus issue, SIB gave coop a fair value of KES 12.42. With the 20% dilution, the fair value now comes to KES 9.94. That should give us a trailing PER of 7.76 (9.94/1.28) But the bonus was credited last week thursday and are already being traded. Thieves

|

|

|

Wazua

»

Investor

»

Stocks

»

coop bank Q1 2012 results

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|