Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

China is in a similar position to the United States in 1931, the emerging super power in the wake of the decline of Great Britain. By 1945, the U.S. had 76% of the world's gold reserves, cementing the reserve status of the Dollar. "According to Michael Lombardi, lead contributor to Profit Confidential, there is mounting evidence of large amounts of buying in the gold market by India, Japan and China. New York, NY (PRWEB) April 30, 2012 According to Michael Lombardi, lead contributor to Profit Confidential, there is mounting evidence of large amounts of buying in the gold market by India, Japan and China. In the article, Two Major Countries Join in China’s Quest for Gold, Lombardi says that, culturally, Asia views gold bullion and the reasons for buying gold bullion differently than we do here in the West...." Read more: http://www.chron.com/bus...-Gold-Buyers-3520622.php

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Graphs for 2012... The global market is ignoring the incoming storm, for how long  S&P 500 vs IBEX 6 year comparison chart. Watch out for that diversion! Either IBEX mounts a hell of a rally to catch up with S&P 500 or the S&P snaps to catch IBEX. Such stack divergence points to a very weak market fundamentals... Global markets are unstable and when the floor caves in, the crash will not be funny. Caution!  Speaks for itself - PIIGS debts vs Bundesbank claims. Really ugly this.   Source: Thomson Reuters Datastream, Bank of Spain  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Five reasons why Kenya and Africa should take off - from World Bank blog... http://blogs.worldbank.o...-africa-should-take-off

Quote:Fifth, economic policies have substantially improved. The 1990s was the decade of controversial structural adjustment. When I was traveling through Africa during that period, black markets were everywhere. Today they are exceptional. Compared to Europe, Africa’s macroeconomic policies look excellent! For example, Kenya’s debt level of around 45 percent of GDP would propel it to one of the top performers in the European Union. So KE's 45% debt to GDP ratio would make it the cream of EU... Salalaa... Dunia kwisa  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Hmmm... after looking at how the monetary wars play screen is unfolding some wild thoughts come to mind... Chinese Yuan - will it be gold backed and will asia be able to counter the west with their own SWIFT system. Arabian gold dinar - will it really see the day without the petro-dollar BRICs reserve currency - will the basket of their currencies suffice... African reserve currency - as per ghadaffi's dreams of a gold back currency Euro - will it crash out or will ze germans and nordics form a nordic euro and kick out the other parasitic members. At the same time will the swiss be able to launch their gold backed swiss franc as they return to gold standard... USD - will it survive the current monetary war to topple it from the reserve seat. Interesting times as the currency war scales up... A recipe for serious trader wars if not a global war. Divine intervention required...  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

An interesting economics exchange between Ron Paul and Prof. Krugman. Ring-side action  http://www.bloomberg.com/video/91689761/ http://www.bloomberg.com/video/91689761/$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

hisah wrote:Five reasons why Kenya and Africa should take off - from World Bank blog... http://blogs.worldbank.o...-africa-should-take-off

Quote:Fifth, economic policies have substantially improved. The 1990s was the decade of controversial structural adjustment. When I was traveling through Africa during that period, black markets were everywhere. Today they are exceptional. Compared to Europe, Africa’s macroeconomic policies look excellent! For example, Kenya’s debt level of around 45 percent of GDP would propel it to one of the top performers in the European Union. So KE's 45% debt to GDP ratio would make it the cream of EU... Salalaa... Dunia kwisa   "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

"I just wanted to come and see how mobile money was being applied in microfinance. I had read a lot about M-Pesa. I was planning to go back to graduate school, but I decided to stay and explore opportunities here,” says Gordon. http://www.howwemadeitin...valley-for-africa/16541/"There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

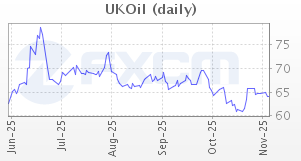

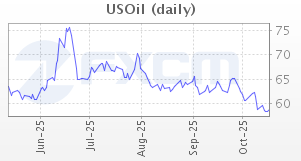

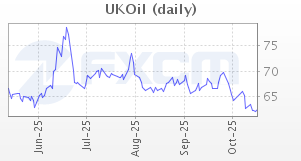

Very glad to see brent taking it in the chin. Hope it breaks below $100. Who needs expensive oil with a limping global economy taking large knocks for a sinking eurozone...  Btw does this mean the persian faceoff has run out of steam? $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Eurostoxx down for weeks, but euro stubbornly up. Divergence! Pound up, FTSE down for weeks, UK in recession. Divergence! Large H&S pattern on weekly chart for canadian stocks -TSX. I continue to fancy the sell side for equities. Too many divergence scenarios in global markets. For ETF, I like BGZ on the buy side. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Yep, europe will determine the global financial & political direction this decade. Sparta has voted out that goldman squid puppet. Sarkozy is french kissed goodbye. In the process Mr Market is not amused and plunges the markets... Ze germans dont like both set of results either. And this is just the beginning of elections in euroland. The Irish referendum this May is another powderkeg. Holland got no cabinet - sept looms. Belgium, no gubberment for almost 2yrs! Will EU be able to hold together? Eurocrats are fast taking in a lot of water. A few months later it will be time to buy the euro. You will know when ze germans hold their elections... http://www.guardian.co.u...ction-financial-markets

And in May 6 2010 the market got to know a 'flash crash'. The window is the same... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Spanish banks to get bailed out. I thought they were preaching that everything is okay. What has changed... Ponzinomics  http://www.bloomberg.com...n-up-spanish-banks.html http://www.bloomberg.com...n-up-spanish-banks.html

Bankia SA, just like Dexia in Belgium this one will cause ripples in Spain. http://www.reuters.com/a...a-idUSBRE84605920120507

This day is coming again, but this time it won't be a rehearsal... https://www.youtube.com/watch?v=WmpNTtQu8E4$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Oh dear Malawi. The Econ hitmen have struck  Malawi devalues kwacha currency by 50% after IMF calls Malawi devalues kwacha currency by 50% after IMF calls - http://www.bbc.co.uk/news/world-africa-17982062

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 2/26/2012 Posts: 15,980

|

Sad, i saw it coming  "There are only two emotions in the market, hope & fear. The problem is you hope when you should fear & fear when you should hope: - Jesse Livermore

.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Slowly it continues, quietly it happens... http://americankabuki.bl...rom-world-banks.html?m=1$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

On a positive note, this I give a thumbs up to CBK for being innovative... Kenyans could soon buy bonds over the phone - http://www.itnewsafrica....y-bonds-over-the-phone/

Quote:An initiative called Treasury Mobile Direct by World Bank and Central Bank will enable Kenyans to purchase bonds using their mobile handsets. The project follows the rise and adoption of mobile handsets in Kenya.

The report (CCK) also focused on the fact that more people are using mobile money deposits rather than traditional banking services to pay for goods and services.

As the project is still in its initial stages, potential investors are required to be registered as mobile money subscribers with the various telecom operators in the country, who will, in turn, open up Central Depository System accounts for them.

The scheme is expected to give rise to a savings culture and increase participation in the bond market. Now Telcos to open CBK CDSC accounts when this goes live! They took deposits from the bankers and now bonds! So now what? Mpesa bank, Airtel bank, Orange bank, Yu bank... KE is redefining the financial game and the world is copying  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

No comment... Remember sparta bond yields rally... Ze germans are now feeling ze squeeze...  Anyone checked out portugal's 10yr bond yield of late... Definitely another bailout is coming in coming weeks. As for espana, 10yr bond yields are back at the Nov 2011 highs before the LTRO hopium prescription. Euroland hopium is now kaput, the junkies have become used to this drug. A more potent concotion is required asap or the junkies commit suicide... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

In a few yrs time, the 1st world will be facing this reality... Then food will be money. http://rt.com/news/cash-burn-hungary-bank-981/$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Egypt still on course to reshape arabia world... http://english.alarabiya...s/2012/05/10/213171.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

EU parliament is getting exciting - www.youtube.com/watch?v=oS6Zaoc6zt0Nigel Farage gives his usual really checks to EU bunge - www.youtube.com/watch?v=hJ6_Ey_MJV4Both short videos, but with a clear message on euroland's grim future under eurocrats unrealistic econ direction. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

hisah wrote:Bloody oil cartel... Someone needs to throw a lead concrete slab at these price appreciation. Crude oil poised to breakout target $108 then $115.  Brent firmly above $120  Me like this for now as oil skids down

Who needs expensive oil...$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|