Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

|

|

|

Rank: Member Joined: 3/20/2009 Posts: 348

|

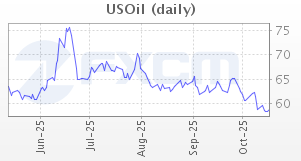

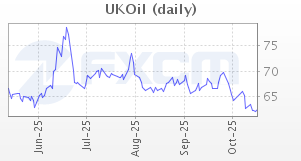

itz wrote:hisah wrote:Cde Monomotapa wrote:Still very, very bearish on oil. So what's so special abt it that it hasn't droppd like the other industrial resources?? Once these "rumours of war" pass-over, it will find its true pricing to the down-side. I'm also on the bear camp when it comes to oil. But since iko na wenyewe, its price movement is always whacky  If this iran tension is resolved pronto, the price collapse will be worse than 2008. If this iran tension is resolved pronto, the price collapse will be worse than 2008. at what price of both brent and WTI would you guyz stop being bears on oil? i dont expect a drop in oil if the economy continues being choppy and not falling off a cliff even if iran is resolved.i expect 126 on brent and 109 on wti in a few weeks here also if the dollar remains at current levels. targets almost hit ,faster than i expected.WTI crude is now at 108.74 and Brent is at 124.50.For kenya all gains made on the shilling gain will mostly be eroded by high brent prices so inflation should stay at this elavated levels

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

itz wrote:itz wrote:hisah wrote:Cde Monomotapa wrote:Still very, very bearish on oil. So what's so special abt it that it hasn't droppd like the other industrial resources?? Once these "rumours of war" pass-over, it will find its true pricing to the down-side. I'm also on the bear camp when it comes to oil. But since iko na wenyewe, its price movement is always whacky  If this iran tension is resolved pronto, the price collapse will be worse than 2008. If this iran tension is resolved pronto, the price collapse will be worse than 2008. at what price of both brent and WTI would you guyz stop being bears on oil? i dont expect a drop in oil if the economy continues being choppy and not falling off a cliff even if iran is resolved.i expect 126 on brent and 109 on wti in a few weeks here also if the dollar remains at current levels. targets almost hit ,faster than i expected.WTI crude is now at 108.74 and Brent is at 124.50.For kenya all gains made on the shilling gain will mostly be eroded by high brent prices so inflation should stay at this elavated levels This oil thing is going parabolic. 2008 once again... Since spotting the bullish signals in early Jan 2012, I became worried on what was about to happen to the price of oil. Importing nations will get a supply shock and with their current high inflation, weak local currencies & wide trade deficits, their economies will be thrown under the bus. Those CBs will be forced to print money to avoid slowdowns/recessions - inflation be damned! Labour wars will escalate - wage hike vs wage cuts vs job cuts. The chaos...

But as usual the current oil moves are unsustainable. When this party is over, the hangover will be interesting. I'd rather wait to short the markets than buy into this hype. The bigger money is on the sellside once the hopium is over.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Interesting view on chingland - http://en.21cbh.com/HTML...24/4MMjM1XzIxMTc4Mw.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

The charts speak for themselves...   Greece 1yr bond yield...  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Oil price rise raises spectre of global recession -- http://uk.reuters.com/ar...n-idUKTRE81P0J420120226

Couldn't be said more clearly... Quote:In euro terms, Brent crude rose to an all-time high of 93.60 euros this week, topping its 2008 record. Graphics courtesy of Reuters.   $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

And this is how oil looks for Asia-Pacific region... Global economy recovery story is about to be thrown under the bus in a bad way...  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Wow! Mobile money is now a large chunk of the KE GDP. Time for treasury to start looking at this innovation seriously on how to improve its mechanism and make it more competitive. Mpesa has too much an upper-hand. What would happen if say mpesa was to cock up for a day or two, that is a huge exposure... http://www.businessdaily...2/-/f2jnlez/-/index.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

S&P downgrades Greece to SD - selective default. Ponzinomics got very interesting since last July. Tomorrow ISDA meets to decide whether this triggers CDS i.e. a credit event. Obviously they'll say it doesn't and all markets will be happy just like the chart below  Gold, silver & USD will get interesting soon as they float in one direction. The long atm queues will hit the headlines as well... Ze Germans may kick out the politicos if ze got ze balls like ze spartans... Polska, Romania & Hungary - watch them too. http://news.yahoo.com/p-...-default-222120479.html

Greece 1yr bond yield...  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

At the Emirates, banks are bracing themselves for a lot of caps... So it's not only KE banks facing caps on interests & fees. http://www.thenational.a...e-for-major-rule-changes$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

For those following the LIBOR manipulation trail since 2010, it's interesting to note that from UK, US, Japan & Canada the top banks are under investigations. This is geting surreal. Is this why many CB heads are resigning as well as most bank CEOs? Is this also why the yen strength has collapsed swiftly the last 12 days? Hmmm  http://www.bloomberg.com...ions-in-libor-probe.html http://www.bloomberg.com...ions-in-libor-probe.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

@hisah we have touched 3,303.75 on the NSE 20 today..  Is it time to buy yet¿¿ Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

guru267 wrote:@hisah we have touched 3,303.75 on the NSE 20 today..  Is it time to buy yet¿¿ Not yet for me

I need to see volumes building up towards 3500 before I can revise my outlook. So far the volume spread for the 3yrs is still below average. CBK needs to force down the CBR sharply (inflation be damned - but they can always fudge it downwards as per IMF's prescription coming soon) in order for Tbills to bleed and the flight back to stocks happens in earnest.

I can see interesting moves here that will make the USDKES to race back to 90s (not go for foreign investors). Such remarks from the KE FinMin need to be discouraged.

http://bit.ly/AxgUdF - updated link

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

hisah wrote:guru267 wrote:@hisah we have touched 3,303.75 on the NSE 20 today..  Is it time to buy yet¿¿ Not yet for me

I need to see volumes building up towards 3500 before I can revise my outlook.

@hisah Have you ever considered that the lack of volumes on the NSE might have been caused by very thin supply rather than weak demand¿¿ From what I observe not many sellers are coming to the party on most stocks on the NSE. They are now being paid to hold on by their companies through dividend... First it was 3,200 now its 3,300 lets talk again at 3,500.. If we do get there that is... Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

MAPUTO, Mozambique, Feb. 29 (UPI) -- East Africa is emerging as the new hot zone for oil and natural gas exploration, with major discoveries by Anadarko of the United States and Italy's Eni in the Indian Ocean off Mozambique and by Norway's Statoil off neighboring Tanzania. Read more: http://www.upi.com/Busin...30532003/#ixzz1nsecbwuA

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Keep watching. The fireworks are coming this month... I am really hoping guys have hedged themselves against the impending fallout across the global financial markets. When ECB subordinated all greece bondholders, the match was struck. Currently the 1 yr Greece bond yield reads 938% in US session and this train wreck is unstoppable. This was never going to end well and the can has been kicked for an unbelievably looong period. @mainat - S&P rating Greece on SD (selective default was an admission of a default event). ISDA met yesterday and ruled that the Greece CDS will not be triggered because Sparta has not defaulted. But the bond market today is not taking this sh** anymore!  ISDA ruling - http://blogs.wsj.com/mar...uling-not-the-last-word/$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

@hisah 1.Greece unlikely to cause anything close to a lehman event due to its relative size. 2. Spanish and italian bond yields are edging lower 3. A greek exit out of the euro likely to strengthen the currency significantly 4. The LTRO has boosted liquidity etc Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

Hisah-breaking news, the game is rigged. Hence why I was so sure there was never going to be a credit event bcos risk dispersion is now a dirty word. I think Greece's problem is simple. Its economy cannot cope with the terms of the deal. EU economists have already admitted this. Greece's collapse is not ze problem. Its the domino effect. Bear Stearns... Sehemu ndio nyumba

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

Mainat wrote:Greece's collapse is not ze problem. Its the domino effect. Bear Stearns... Watch the other PIIGS interest rates fall Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

guru267 wrote:Mainat wrote:Greece's collapse is not ze problem. Its the domino effect. Bear Stearns... Watch the other PIIGS interest rates fall A kodak moment... I hope you got your cameras  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|