Wazua

»

Investor

»

Stocks

»

Dividend Investing

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Dividend Investing. The NSE theme for 2012. Growth companies will experience a higher rate of revenue slowdown than bluechips as high inflation stubbornly refuses to go away. So higher dividend payouts is the strategy firms will use to try and rope in investors from fleeing (selling/dumping) their stocks. Any firm that cuts their dividend pay or skips it this year, will see investors selling its stock mercilessly. High dividend payouts in a bear market usually reinforce the bear! So expect the NSE to continue sagging (increases the dividend yield metric) or at best trade sideways for the year. If CBK can force down the tbill rates below 13%, stocks will head higher than trade sidesways since it will be a signal CBR will be lowered despite high inflation! Mimi bado niko kwa tbills and fancing tea leaves as in liking agri firms... All the best  http://whatisdividend.co...g/dividend-investing-2/ http://whatisdividend.co...g/dividend-investing-2/

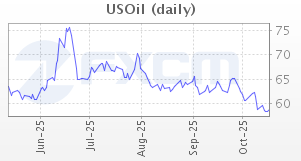

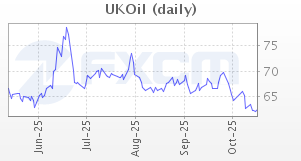

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

hisah wrote:

High dividend payouts in a bear market usually reinforce the bear! So expect the NSE to continue sagging (increases the dividend yield metric) or at best trade sideways for the year.

@hisah we closed the index yesterday at 3,199.67.. The resistance level of 3200 will be broken today.. The bears are losing their argument now... Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

guru267 wrote:hisah wrote:

High dividend payouts in a bear market usually reinforce the bear! So expect the NSE to continue sagging (increases the dividend yield metric) or at best trade sideways for the year.

@hisah we closed the index yesterday at 3,199.67.. The resistance level of 3200 will be broken today.. The bears are losing their argument now... Not so fast. The volume spread still indicates distribution. If 3300 is broken with conviction then next is 3500. Huge buy volumes needed to push to those levels.

My biggest skeptism is being fanned by global oil with KE on high inflation rates.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

@Hisah. You had once said that, investors buying stocks for dividends is unique to the NSE. I found this interesting as i thought inverstors' value for dividends was universal. They are spoiling us aren't they? the dividend yeilds are so sweet! Lets see what the companies yet to report have to offer. I agree on the mercilessly Truth be told, since winter set in, i've been looking out for firms with good dividends that have future capital appreciation prospects, and fetching them at a nice low price where the yield is also high. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 6/20/2007 Posts: 2,067 Location: Lagos, Nigeria

|

A defensive way of investing all the time with moderate gains in all market conditions. If you lose the capital gain you will always be compenssated with good dividends. To achieve this your stock portfolio should consists of high dividend yield highly capitalized stocks. Stocks that give good interim and final dividends makes it even more interesting. The wazua spirit as members is to educate and inform and learn from others within the limit of what we know in any chosen area irrespective of our differences in tribes, nationalities, etc. .

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

hisah wrote:

Not so fast. The volume spread still indicates distribution. If 3300 is broken with conviction then next is 3500. Huge buy volumes needed to push to those levels.

My biggest skeptism is being fanned by global oil with KE on high inflation rates.

@hisah have you asked yourself why T.A's/chartists always underperform fundamentalists¿¿ You are busy waiting for 3,500 on the NSE 20 to be broken while I took the plunge at 3,100.. Ultra low P/E's and Ultra high dividend yields have always been the signal to buy equities.. From the looks of your posts it looks like you tend to get in at the top of the cycle.. Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

guru267 wrote:hisah wrote:

Not so fast. The volume spread still indicates distribution. If 3300 is broken with conviction then next is 3500. Huge buy volumes needed to push to those levels.

My biggest skeptism is being fanned by global oil with KE on high inflation rates.

@hisah have you asked yourself why T.A's/chartists always underperform fundamentalists¿¿ You are busy waiting for 3,500 on the NSE 20 to be broken while I took the plunge at 3,100.. Ultra low P/E's and Ultra high dividend yields have always been the signal to buy equities.. From the looks of your posts it looks like you tend to get in at the top of the cycle..

|

|

|

Rank: Elder Joined: 9/12/2006 Posts: 1,554

|

guru267 wrote:hisah wrote:

Not so fast. The volume spread still indicates distribution. If 3300 is broken with conviction then next is 3500. Huge buy volumes needed to push to those levels.

My biggest skeptism is being fanned by global oil with KE on high inflation rates.

@hisah have you asked yourself why T.A's/chartists always underperform fundamentalists¿¿ You are busy waiting for 3,500 on the NSE 20 to be broken while I took the plunge at 3,100.. Ultra low P/E's and Ultra high dividend yields have always been the signal to buy equities.. From the looks of your posts it looks like you tend to get in at the top of the cycle.. @Guru... Good observation

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

guru267 wrote:hisah wrote:

Not so fast. The volume spread still indicates distribution. If 3300 is broken with conviction then next is 3500. Huge buy volumes needed to push to those levels.

My biggest skeptism is being fanned by global oil with KE on high inflation rates.

@hisah have you asked yourself why T.A's/chartists always underperform fundamentalists¿¿ You are busy waiting for 3,500 on the NSE 20 to be broken while I took the plunge at 3,100.. Ultra low P/E's and Ultra high dividend yields have always been the signal to buy equities.. From the looks of your posts it looks like you tend to get in at the top of the cycle.. If only this were true esp about buying the tops  You assume that I only look at charts (cartoons as so called of late) and don't bother with fundamentals... You assume that I only look at charts (cartoons as so called of late) and don't bother with fundamentals...

Everyone has there own investing plan. I am not a buy and hold investor. I monitor the trend of the index - this is important to my plan. If the index is bearish, I short the index plus bearish stocks (NSE doesn't permit this), if bullish, I buy - the index plus the bullish stocks. Above 3500 and if huge volumes permit NSE reaches those levels will get me reviewing my NSE outlook. Yes, @guru you may be 50% up in a particular stock by then

I'll say it again, when oil goes parabolic everything comes down crashing (fundamentals will tell you expensive oil esp an oil price shock as it is about to happen soon is bad for importing economies - inflation, slowdown [GDP, profits], labour unrests etc). I will not participate in the current madness, which defies the global GDP slowdown reality.

Hope this settles the cartoons and the fundamental debates.

Once again keep watching the oil price parabolic and let's see how firms continue to post staggering profits and global economy rallies with a euroland deep in debt

Kila nyani na mkia wake...

Just as a remainder. All the best.

Greece 1yr bond yield...

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 2/20/2007 Posts: 359

|

guru267 wrote:hisah wrote:

Not so fast. The volume spread still indicates distribution. If 3300 is broken with conviction then next is 3500. Huge buy volumes needed to push to those levels.

My biggest skeptism is being fanned by global oil with KE on high inflation rates.

@hisah have you asked yourself why T.A's/chartists always underperform fundamentalists¿¿ You are busy waiting for 3,500 on the NSE 20 to be broken while I took the plunge at 3,100.. Ultra low P/E's and Ultra high dividend yields have always been the signal to buy equities.. From the looks of your posts it looks like you tend to get in at the top of the cycle.. Kudos!! Some peeps determine the cycles while others react to the cycles. The former read the facts and move, while the latter wait to see whereto the movement leads before they can decide. As investors, we plant___ . a) before the rains b) after waiting for the weather forecast; if it forecasts adequate rainfall c) after waiting to see if actual rains are adequate to sustain crops d) all of the above

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

slykat wrote:

As investors, do we plant before the rains or do we wait to see if the rains are adequate to sustain crops?

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

I also think @hisah's business climate has become hazier than ever before esp.with declining Western economics. Take a chill pill bro n' re-strategize. SSA no.s speak for themselves even after a year 2011 that I concur was really tricky.

|

|

|

Rank: Veteran Joined: 11/11/2006 Posts: 972 Location: Home

|

"The only thing that gives me pleasure is to see my dividend coming in." --John D. Rockefeller. http://www.investopedia.com/art...sics022412#axzz1nKOrQN9B

|

|

|

Rank: User Joined: 1/24/2012 Posts: 1,675 Location: In Da Hood

|

guru267 wrote:hisah wrote:

Not so fast. The volume spread still indicates distribution. If 3300 is broken with conviction then next is 3500. Huge buy volumes needed to push to those levels.

My biggest skeptism is being fanned by global oil with KE on high inflation rates.

@hisah have you asked yourself why T.A's/chartists always underperform fundamentalists¿¿ You are busy waiting for 3,500 on the NSE 20 to be broken while I took the plunge at 3,100.. Ultra low P/E's and Ultra high dividend yields have always been the signal to buy equities.. From the looks of your posts it looks like you tend to get in at the top of the cycle.. Ohhh ! where is this head-less chicken running to ...does it have legs to 3500 ??? lets see!

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

History has shown and proved that take what @hisah says seriously...be extra careful on banks especially the aggressive ones & those doing rights issues...I have picked up trends that the market hasnt seen yet...2012 will be tough...2011 was just a teaser.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

So far KPLC is behaving as expected in this high dividend payout environment - measly payout interims or final dividend will get your stock hammered... The price move this morning so far is interesting... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 6/17/2009 Posts: 1,622

|

hisah wrote:So far KPLC is behaving as expected in this high dividend payout environment - measly payout interims or final dividend will get your stock hammered... The price move this morning so far is interesting... That is because it has gone ex-bonus,nothing to do with the interim dividend.

|

|

|

Rank: Veteran Joined: 12/23/2010 Posts: 1,229

|

cnn wrote:hisah wrote:So far KPLC is behaving as expected in this high dividend payout environment - measly payout interims or final dividend will get your stock hammered... The price move this morning so far is interesting... That is because it has gone ex-bonus,nothing to do with the interim dividend. Though so. Not that I'm smiling at the dividends.

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

For Sport wrote:cnn wrote:hisah wrote:So far KPLC is behaving as expected in this high dividend payout environment - measly payout interims or final dividend will get your stock hammered... The price move this morning so far is interesting... That is because it has gone ex-bonus,nothing to do with the interim dividend. Though so. Not that I'm smiling at the dividends. @cnn. I initially thought so. However. The stock Was trading at 18.00 levels when bonus was announced, due to excitement. Then dropped to 15-16 levels. 17 before book closure. The drop today i believe is as a result of an eps of 1.17, due to the massive dilution of bonus, and share actions last year. I wont be shocked to buy this share at 10-12 bob, in the coming months. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

So CFC bank becomes the first firm to post double digit profit gains and says no dividend candies. This will be interesting. Really lucky its stock is illiquid. Lets wait and see the price action by Q2 when they'll have a capital call. http://af.reuters.com/ar...s/idAFL5E8E76KQ20120307

Now lets see if SCB & COOP will also lookup the dividend cookie jar. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Stocks

»

Dividend Investing

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|