Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Member Joined: 3/20/2009 Posts: 348

|

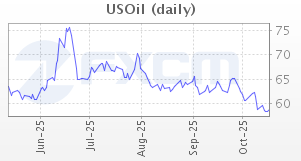

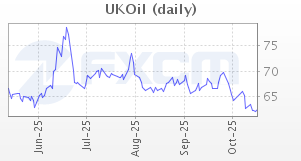

hisah wrote:hisah wrote:Bloody oil cartel... Someone needs to throw a lead concrete slab at these price appreciation. Crude oil poised to breakout target $108 then $115.  Brent firmly above $120  Crude oil closed @ $104. Since Nov 2011, $103 has been tough resistance, which has now been broken.

Nothing is making sense this yr, global markets gone berserk. Expensive oil, recessing euroland, huge econ downgrades by rating agencies & world bank to boot making G10 CBs cranky to go hyper money printing again to avoid deflation, collapse of the baltic dry index (shipping activity) and an expensive USD...

Since this doesn't make financial sense anymore, any holy men here to offer a divine interpretation of the current situation. it has been a massive short squeeze of the year that started in october.if you remember last year US and the world were supposed to go into a double dip recession which didn't happen.US started reporting positive news (unemployment data,GDP suprise up 2.8%,rise in manufucturing index,rise in consumer confidence from lows of 50 to 73,earnings beat by many S&P and nasdaq companies,facebook mania,change in sentiment,managers trying to beat their benchmarks from last year's underperfomance and the herd buys equities all at the same time,QE3 speculation,ECB priming and all this time many investors have been shorting the market adding fuel to the fire forcing them to cover at higher prices.The move has been epic i dont know how it ends but its never a good ending but markets can stay like this for a long time which am sure u know.Nasdaq is back to 2000 levels

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Iran 'halts oil sales to France and Britain' http://www.bbc.co.uk/new...ld-middle-east-17089953

Haha! If this turns out to be true, the guns are drawn! Iran is clearly saying 'Bring it on!' GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Last week it was greeks, this week it's spaniards... http://elpais.com/elpais...h/1329664883_704076.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 1/13/2011 Posts: 5,964

|

Still very, very bearish on oil. So what's so special abt it that it hasn't droppd like the other industrial resources?? Once these "rumours of war" pass-over, it will find its true pricing to the down-side.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Cde Monomotapa wrote:Still very, very bearish on oil. So what's so special abt it that it hasn't droppd like the other industrial resources?? Once these "rumours of war" pass-over, it will find its true pricing to the down-side. I'm also on the bear camp when it comes to oil. But since iko na wenyewe, its price movement is always whacky  If this iran tension is resolved pronto, the price collapse will be worse than 2008. If this iran tension is resolved pronto, the price collapse will be worse than 2008.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 3/20/2009 Posts: 348

|

hisah wrote:Cde Monomotapa wrote:Still very, very bearish on oil. So what's so special abt it that it hasn't droppd like the other industrial resources?? Once these "rumours of war" pass-over, it will find its true pricing to the down-side. I'm also on the bear camp when it comes to oil. But since iko na wenyewe, its price movement is always whacky  If this iran tension is resolved pronto, the price collapse will be worse than 2008. If this iran tension is resolved pronto, the price collapse will be worse than 2008. at what price of both brent and WTI would you guyz stop being bears on oil? i dont expect a drop in oil if the economy continues being choppy and not falling off a cliff even if iran is resolved.i expect 126 on brent and 109 on wti in a few weeks here also if the dollar remains at current levels.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@itz - how do you expect the recessing euroland to pay for expensive oil together with most developing economies still smarting from the oil inflation of 2011, which gave a number of central bankers nightmares managing their local currencies? As per world bank's GEP for 2012, global GDP forecast for this year is lower than 2011 due to the slowdowns ongoing in most economies pointing to looming recessions and stagflations at worst case. World Bank wrote:Developing countries should prepare for further downside risks, as Euro Area debt problems and weakening growth in several big emerging economies are dimming global growth prospects, says the World Bank in the newly-released Global Economic Prospects (GEP) 2012. http://nextbigfuture.com...-weaker-global-gdp.html

wikipedia wrote:Economists offer two principal explanations for why stagflation occurs. First, stagflation can result when the productive capacity of an economy is reduced by an unfavorable supply shock, such as an increase in the price of oil for an oil importing country. Such an unfavorable supply shock tends to raise prices at the same time that it slows the economy by making production more costly and less profitable.

Second, both stagnation and inflation can result from inappropriate macroeconomic policies. For example, central banks can cause inflation by permitting excessive growth of the money supply, and the government can cause stagnation by excessive regulation of goods markets and labor markets hisah's comment - euroland has banned oil import from Iran starting from July. Iran may induce it earlier than euroland's plan!. Either of these factors can cause stagflation. Excessive growth of the money supply taken to such an extreme that it must be reversed abruptly can clearly be a causehisah's comment - a number of developing nation's have hiked central bank's interest rate and some central banks have intervened in the forex markets to stablize their currencies. Both types of explanations are offered in analyses of the global stagflation of the 1970s: it began with a huge rise in oil prices, but then continued as central banks used excessively stimulative monetary policy to counteract the resulting recession, causing a runaway wage-price spiral. https://en.wikipedia.org/wiki/Stagflation

- Technically brent prices should test $125 and if surpassed vault to $150. And worse should Iran tension spiral out of control. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 3/20/2009 Posts: 348

|

@hisah. yes higher oil prices will stall world economic growth as it has shown in the past, brent over 110 slows down economies because they cannot sustain at this higher levels.However there is always a lag effect which takes time before you start seeing lower economic indicators because of high oil prices which should be seen at the start of the 2nd quarter 2012.With Iran cutting supply to Britain,Saudi lowering output in Dec,China easing over the weekend i expect as you said oil above 125 but which cannot be sustained for long due to weaker global growth.in the short term it is headed there.what was your timeframe on when oil goes lower

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

itz wrote:@hisah. yes higher oil prices will stall world economic growth as it has shown in the past, brent over 110 slows down economies because they cannot sustain at this higher levels.However there is always a lag effect which takes time before you start seeing lower economic indicators because of high oil prices which should be seen at the start of the 2nd quarter 2012.With Iran cutting supply to Britain,Saudi lowering output in Dec,China easing over the weekend i expect as you said oil above 125 but which cannot be sustained for long due to weaker global growth.in the short term it is headed there.what was your timeframe on when oil goes lower Most likely in July 2012 assuming the Iran situation doesn't blow up into a full scale war. If it does there will be no ceiling to cap those prices  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Very interesting videos... https://www.youtube.com/...feature=player_embedded

https://www.youtube.com/...hl=en&v=iaGCJmCAJ40

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

I can see on March 8, matatus intend to go on strike. Now when brent is above $125 and crude above $115, I wonder if they'll call another strike due to fuel price escalation. Indeed just as 2011 started so is 2012 with labour fights escalating. But I really fear for Nigeria if the fuel subsidy is permanently removed. There will be a revolt in that nation as they clearly sent a message back in Jan 2012. http://www.nation.co.ke/...4/-/pug9oz/-/index.html

http://af.reuters.com/ar...s/idAFL5E8DK19V20120220

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

I get mad seeing such talent going to waste while some politicos are busy bickering about tribal politics... https://www.youtube.com/...ture=endscreen&NR=1

Hmmm... Konza city was also presented at Stanford University. https://www.youtube.com/watch?v=iNxGFBVSwPU$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Iran says it could attack first http://www.bbc.co.uk/new...ld-middle-east-17116588

That should keep oil higher... GOD BLESS YOUR LIFE

|

|

|

Rank: Veteran Joined: 5/23/2010 Posts: 868 Location: La Islas Galápagos

|

hisah wrote:I can see on March 8, matatus intend to go on strike. Now when brent is above $125 and crude above $115, I wonder if they'll call another strike due to fuel price escalation. Indeed just as 2011 started so is 2012 with labour fights escalating. But I really fear for Nigeria if the fuel subsidy is permanently removed. There will be a revolt in that nation as they clearly sent a message back in Jan 2012. http://www.nation.co.ke/...4/-/pug9oz/-/index.html

http://af.reuters.com/ar...s/idAFL5E8DK19V20120220

Inflation and interest are inversely related, and these e-CON-omists have been telling us interest rates follow inflation A bad day fishing is better than a good day at work

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

I can see BD has also started paying attention to intl oil prices and not ERC. Another round of oil inflation is on the cards and CBs will yet again fight for local currencies as they get knocked about by USD demand for import bill cover. High oil prices, strong USD demand, stubbornly high inflation and you have an econ cocktail reading recession or stagflation. This cocktail will keep a lid on NSE preventing recovery and soon the same theme will be on global stocks. Add a Greece default and the cocktail becomes poison. Watch tbills, USDKES, fuel pump prices, power bills, CBR for a clue on how to shield your investments. I'd also be out of loans. At 82/83s USDKES is a buy for me. I still see the cross going back above 90s by year end. CBK cant print oil nor food. Those 2 commodities will cause havoc to many treasury ministries globally. http://bit.ly/Ae9YrZ$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 9/4/2009 Posts: 700 Location: Nairobi

|

The East African ride to Middle Income read more: http://blogs.worldbank.o...an-ride-to-middle-income“We are the middle children of history man, no purpose or place. We have no great war, no great depression. Our great war is a spiritual war, our great depression is our lives!" – Tyler Durden

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Headed out of this galaxy aka fantastic voyage! https://www.youtube.com/...I7c&feature=related

Greece 1yr bond yield  This is a strong warning that a major market correction aka crash is on the cards. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

On Feb 29 another ECB LTRO will expand their balance sheet. LTRO 2.0 will be twice as large than the first round. In short ECB is stealthly printing money which people thought it cant  Definitely this rapid money expansion is going to bite back when the time comes, but in the meantime expect commodities to rally like mad. So oil will not only be boosted by iran tensions, but also this money tsunami?! How this is supposed to help PIIGS & the global economy is anyone's guess in this global ponzinomics... http://www.ftense.com/20...n-bank-bailout.html?m=1

+ECB+Balance+feb+1.gif) $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Russia warns Israel against striking Iran - http://edition.presstv.i...e/detail.aspx?id=228019

Greece parliament may just pass bills that increase the bondholders bond haircuts... http://www.dowjones.com/...uro-ZoneDebtFallout.asp

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|