Wazua

»

Investor

»

Economy

»

Investors Lounge

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

Ladies and Gentlemen, The following interview with Ellis Martin of www.EllisMartinReport.com covers in detail the impending undeclared default of 5 major US banks this week by the International Swaps and Derivatives Association. This even has the potential to cause a second financial crisis that would require significant financial intervention. If you have time to spare, listen to this interview. If you don’t have time to spare, listen to it anyway. http://www.jsmineset.com...lt-of-5-major-us-banks/

|

|

|

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

KK-I won't worry about the story. Part of the Greek negotiation will be that the 70% haircut won't be an credit d even Sehemu ndio nyumba

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Mainat wrote:KK-I won't worry about the story. Part of the Greek negotiation will be that the 70% haircut won't be an credit d even I like your confidence! The CDS distress signals flashing since July 2011 are indicating an event is on the horizon. This is why I've been stating of late portuguese instead of greece.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

Hisah-the Greece negotiations have taken so long because the EU wants to use it as a template for having EU countries partially default without it being called a credit event. Yani forcing lenders to take losses capitalist style. Sehemu ndio nyumba

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Mainat wrote:Hisah-the Greece negotiations have taken so long because the EU wants to use it as a template for having EU countries partially default without it being called a credit event. Yani forcing lenders to take losses capitalist style. Is it workable? How do you force vulture hedgefunds to take losses by force without consequences...?$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

Hisah-a lot of those bondholders that hold Greece also foolishly hold other PIGS. If they are unwilling to negotiate and Greece falls under the bus, the value of their other holdings will head towards 0. Its better to book 30% than 0. Ama? Sehemu ndio nyumba

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Mainat wrote:Hisah-a lot of those bondholders that hold Greece also foolishly hold other PIGS. If they are unwilling to negotiate and Greece falls under the bus, the value of their other holdings will head towards 0. Its better to book 30% than 0. Ama? It's a shotgun party, but I think the hedgies could pull a grenade under the table with those CDS games... This is why I don't see how a credit event can be avoided. The insurance costs will bomb out and looking at Allianz and Societe Generali exposures, it's not a nice scenario. This reminds me of AIG. It all looked rosy until the plug was pulled on Sept 15 2008.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

Hisah- I am no expert on what is or is not a credit event (ISDA is). However, pls note that voluntary debt restructuring agreements rarely qualify to be categorized as a credit event. In anycase, I believe the cds sellers are also in the talks. As a generic point, capitalism will never work if people are not allowed to fail Sehemu ndio nyumba

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

First it was 3 states, now more are joining in. The vote of no confidence on the USD is growing louder... http://finance.yahoo.com...cies-gold-100700922.html$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: User Joined: 1/24/2012 Posts: 1,675 Location: In Da Hood

|

warren buffet is way cool than most of you guys think !

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Well, well, well. What do you know. The Russians and Chinks have only gone and vetoed the UN resolution on Syria http://www.bbc.co.uk/news/world-16890107

This should be a wake up call to those hell-bent on spreading democracy (read thieving) at all costs GOD BLESS YOUR LIFE

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

youcan'tstopusnow wrote:Well, well, well. What do you know. The Russians and Chinks have only gone and vetoed the UN resolution on Syria http://www.bbc.co.uk/news/world-16890107

This should be a wake up call to those hell-bent on spreading democracy (read thieving) at all costs Chirussia united vs USUK... So far 1-0 to Chirussia at half time.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

From 2011 to date, labourers/workers/citizens etc are exhibiting a tipping of the scale event coming soon to the system i.e. the money & power (gubberment) centres... http://www.euronews.net/tag/strike/$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

I had posted this cold fusion energy break thru some time back. This thing is causing discomfy to the black gold cartel. I hope Rossi doesn't end up like Nikola Tesla. http://www.youtube.com/watch?v=p1W3Vm1HUO8 - Most info under the description tab of the video. Interesting rinks there. Meanwhile 2 largest Greek union to strike tomorrow (against austerity) - members are almost half of the nation's work force. Also the nobel peace price jury is under investigations. No rinks for those two updates (I'm feeling lazy), just google to find them. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

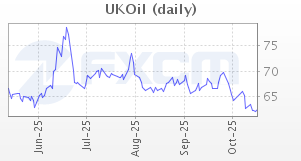

Brent oil about vault into breakout! Expensive oil back on the radar  Yet again oil will crash the markets esp now that the euroland recession is unfolding with a debt bomb to boot.  Techies & chartists, check out the 2yr breny chart and look at the falling trendline. $125 will get tested soon. And such news obviously adds fuel to the impending breakout. http://www.usatoday.com/...srael-nuclear/52956282/1$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

NEW YORK (CNNMoney) -- A growing number of states are seeking shiny new currencies made of silver and gold. Worried that the Federal Reserve and the U.S. dollar are on the brink of collapse, lawmakers from 13 states, including Minnesota, Tennessee, Iowa, South Carolina and Georgia, are seeking approval from their state governments to either issue their own alternative currency or explore it as an option. Just three years ago, only three states had similar proposals in place. Read more: http://money.cnn.com/201...3/pf/states_currencies/

|

|

|

Rank: Member Joined: 11/13/2006 Posts: 551 Location: Nairobi

|

@ Mainat. A credit event is a declaration that will allow those institutions that took insurance on their sovereign debt portfolios to collect on that insurance. If the default is not declared a credit event, not only will the bondholders get a 70% haircut, but they will also not collect on their insurance. It is akin to your house burning due to faulty wiring and the insurance company declaring it an arson attack therefore no compensation.

|

|

|

Rank: Veteran Joined: 11/21/2006 Posts: 1,590

|

KK- I know what a credit event is, but the criteria for defining something as a credit event is very complex. Even if your house burnt down, please note that an insurer only pays out when they are 100% sure that it was an event that fits their criteria for paying out. Greece will fall over because its society might balk at the required changes. Sehemu ndio nyumba

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

DJIA, S&P500, NASDAQ and Brent Oil - Monthly RSI creeping into overbought zone! A significant top is being telegraphed... Patience. Soon rogue trading will be a subject again. Reminds me of Alessio Rastani - https://www.youtube.com/watch?v=lrXgQDeOFb8 $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

President Jakaya Kikwete has said Tanzania’s government has experienced serious financial difficulties in the recent past, revealing it was overwhelmed by debts. http://www.nation.co.ke/...2/-/w6ixe9/-/index.html

GOD BLESS YOUR LIFE

|

|

|

Wazua

»

Investor

»

Economy

»

Investors Lounge

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|