Wazua

»

Investor

»

Stocks

»

BRITAK Prospects

Rank: User Joined: 11/10/2010 Posts: 550 Location: Junction

|

Mainat wrote:Kausha/Kihangeri, may I welcome you to Kenya. Kenya is blessed with healthy productive people (growing at 1million per year). Please help yourself to some of our chai.

Kenya has a CAPITALIST economy. This means I bring something to the market, you bring your money (shillings if possible unless you are from Somali) and we agree how much you'll pay for my something. Alternatively I put a marked price on my something and you have to decide whether its worth that price.

Karipu You are giving my country a bad name. What you are suggesting is called Vulture capitalism. That is why we need consumer protection to prevent the vulture capitalist from selling us substandard goods and congame services in the name of maximizing profits. Remember, NSE is not a fish market to entertain Jaboya deals. That is why Americans are up in arms against Romney. Every once and a while, a VC will get lucky and find a business and a business owner desperate enough to accept VC funding, and have that company thrive. Staples, in Romney's case, may be one of those. But in the meantime, there are probably hundreds of orphan companies that run well enough on their own, but cannot grow fast enough to meet VC expectations, or rise to VC-imposed debt obligations. A VC like Romney will gut them, fail the company, and everyone except Romney loses. That's how Romney created $250 million in net worth for himself: By breaking the backs of otherwise hard-working, honest American workers and entrepreneurs. I hate people like that. If you have a good business, stay away from vultures like Romney and grow your company, and provide for your employees. http://rickperryreport.c...mney-vulture-capitalist

By inference, the man is all that Mr Phantom is not: an untrustworthy radical, divisive, too many enemies, a dictator, and a persistent liar...Gaitho dialogues.

|

|

|

Rank: Member Joined: 7/7/2008 Posts: 124

|

I said then during the IPO,"The maths at the end of financial year will be the waterloo for this stock and that is when I will get in!!After all,as a policy holder with them I need to profit from the business.But this financial year they will make no profits and if they do, no dividends.Period!Someone remind me, when is their financial year(bookclosure)?"(CIRCA 05/08/2011)

And now we are right there...profit warning included!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@Kihangeri - I can see you 'like' Flipflopper romney  Something about his flipflops here - http://www.youtube.com/watch?v=CUzEJiFpmsQ

Seems politicians go to the same global school after all since they act the same across the world... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

youcan'tstopusnow wrote:Cde Monomotapa wrote:Aguytrying wrote:Cde Monomotapa wrote:Mainat wrote:Sure-look out for it in the news later on today.

Cde-yes there was a profit warning the prospectus. I believe Britak is just conforming to requirements for listed firms... cheers. there was no profit warning in the prospectus, i read it. We discussed the lack of it on end here on wazua. Ok comrade.. I withdraw to mind my own biz  endeleeni na kazi. A look at Appendix 4 (Management accounts to 30 April 2011) would have told you a lot The PAT for the 4 month period stood at 407,012,000 while for the corresponding period in the previous year was at 1,316,253,000 and the investment income declined to 415,466,000 from 1,895,418,000 Also notice this statement: The Group made a profit before tax of Kshs 2.87 billion as compared to a loss before tax of Kshs 334 million in 2009. This positive performance was the result of unrealised fair value gains on equity investments amounting to Kshs 3.56 billion in

2010 compared to unrealised fair value losses of Kshs 574 million included in 2009. This outcome is a reflection of the good

performance of the Stock Market during the year.What more did anyone need? The information was there, thats why i personally avoided this thing like a plague. However the company did not officiall issue a profit warning. Also why issue a profit warning after finacial year end. it should have been done at H1....which was during the IPO. bang. LFMAO. If the fair value gains enable such a recovery in FY 2010, imagine what a complete reversal will do!!! I know what they'll do, they'll announce them separetly like CFCIH did. Poooole sana.....(like Maina Kageni says). @yucant. thank God we aint in this train wreck. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

Mainat wrote:Kirita-thanks. Agu-to be clear, in 2010 Britak made Ksh2.7bn PAT and it projected Ksh1.0bn for 2011 a 62% fall. Infact, the profit warning is rosier. Please confirm this is prospectus you saw http://bit.ly/Au1T1T

Btw, hadn't realised that the Ekweity duo still own 11% of Britak I agree with you. Its only the manner in which they issued it, they didn't do it like the other companies do, an official press statement......wait, like they did two days ago.....why would they issue a profit warning twice in one year? We are saying the same thing, they indicated that their profits would drop in the prospectus, but not a press statement,which they have now done, convineintly well after the IPO The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Chief Joined: 3/24/2010 Posts: 6,779 Location: Black Africa

|

Aguytrying, imagine immediately after the shares were allocated, the management issued a profit warning. Hehe. There would have been an uproar which would have culminated in #OccupyBritak GOD BLESS YOUR LIFE

|

|

|

Rank: User Joined: 8/29/2011 Posts: 1,045 Location: Mtaani

|

lol. this flash backs are funny !!!! now it seems there was a profit warning !!!!!!

|

|

|

Rank: Veteran Joined: 4/30/2010 Posts: 1,635

|

|

|

|

Rank: Member Joined: 10/14/2011 Posts: 661

|

British American will shift its investments from stocks to real estate, CENTUM has substantially invested in this sector recently. Real estate still remain an attractive investment segment with huge growth prospects and an area of focus for companies intend on growing their numbers (income), this inspite of the current economic downturn /conditions –High interests, decline in loan and mortgage intake etc. http://www.businessdaily...2/-/ba2lxv/-/index.html

Prospects (sector) -HF http://www.capitalfm.co....t-about-2012-prospects/

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

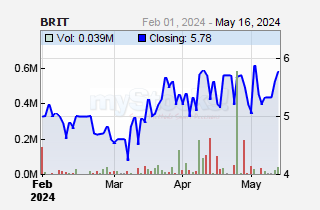

mlennyma wrote:Britak owns hfck and equity chunks of shares about 26% and both have lost value over 50%...profit dip a must..run away until you see the price at 2bob. Still crash landing. What a 'spectacular' post IPO performance. This is one share that has seen extreme sell-side pressure as it closed below IPO price since 1st day of listing. When the bull returns, this thing will rebound furiously. But for now the bear is still hugging it strongly... The chart below shows 3/- will be hit in coming weeks as per volume spread.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Member Joined: 11/26/2009 Posts: 67 Location: Pare pare

|

Was searching for some info on britak and this came my way, Finally something that puts me in the loop :) http://britakinsyder.blogspot.com/ Hug the bear....ride the bull.....di$mount!!!

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

Yeah @Hisah it's easy for you to be posting charts here and there...what happened to your Mpesa venture? You exited the stock prematurely...only for it to rally 16%...

|

|

|

Rank: User Joined: 1/24/2012 Posts: 1,675 Location: In Da Hood

|

lol...safaricom is a funny stock . i think the best thing to do is just to buy it and forget it ! coz even applying some technical analysis is pretty hard !

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

the deal wrote:Yeah @Hisah it's easy for you to be posting charts here and there...what happened to your Mpesa venture? You exited the stock prematurely...only for it to rally 16%... The moment it broken down 2.90, I had to relook everything afresh & the volume spread on that break signalled indecision. Yes, it's up 16%, but the volume spread to date indicates distribution and not accumulation.

$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

|

|

|

Rank: Veteran Joined: 5/23/2010 Posts: 868 Location: La Islas Galápagos

|

[quote=Simplified]Was searching for some info on britak and this came my way, Finally something that puts me in the loop :) http://britakinsyder.blogspot.com/[/quote] These are either very well written stories, or the TRUTH - SCARY VERSION A bad day fishing is better than a good day at work

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

the deal wrote:sawa sawa @hisah Btw wont be surprised to see a rally towards results time in May. The volume spike after the results news on the following day will confirm the distribution taking place at the moment. Then the no demand phase will shortly follow.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/25/2009 Posts: 4,534 Location: Windhoek/Nairobbery

|

hisah wrote:the deal wrote:sawa sawa @hisah Btw wont be surprised to see a rally towards results time in May. The volume spike after the results news on the following day will confirm the distribution taking place at the moment. Then the no demand phase will shortly follow. LOL the boeing needs a new pilot...I resign after two years of service.

|

|

|

Rank: Elder Joined: 7/11/2010 Posts: 5,040

|

I'll be very surprised if britak profits fall by only around 25 percent. Infact i'll be suprised if they announce any profits. I hope wanjiku learned something here, but wait, they never learn. The investor's chief problem - and even his worst enemy - is likely to be himself

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

Aguytrying wrote:I'll be very surprised if britak profits fall by only around 25 percent. Infact i'll be suprised if they announce any profits. I hope wanjiku learned something here, but wait, they never learn. Never underestimate the power of book cooking. Bear markets are a good breeding ground... Expectations no matter how ugly must be managed.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Stocks

»

BRITAK Prospects

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|