Wazua

»

Investor

»

Stocks

»

Stock traders Corner.

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

QW25081985 wrote: what kind of charts is that ?? give us candlestick charts , bwana @qw - must it be a candle stick chart... The pattern is the pattern... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

QW25081985 wrote:the deal wrote:That disconnection between the Shilling rally and the NSE rings alarm bells considering the stock market moves ahead of events. DIVERGANCE !!!!!!!!!!!!!!!!!!!!!!! something of the two has to catch up ..i have also noted the disconnect. am thinking stocks should be rallying but yet again we have too much risk ahead . but i hoe the shilling at 85 will lend the stock market some support KES rally is based on USD IMF support and not fundamentals of the squeaking econ. Thats the stocks slump vs KES rally disconnect. And KES is a horrible liar. I've also pointed out the inverted yield curve scenario in the money market in another thread. Read about inverted yield curve outcomes. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

@hisah, What is the effect of O6? this is the week we expect confirmation ama? Just a reminder and not related to the curves. The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

jerry wrote:@hisah, What is the effect of O6? this is the week we expect confirmation ama? Just a reminder and not related to the curves. @jerry - I don't get your query?$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: User Joined: 8/29/2011 Posts: 1,045 Location: Mtaani

|

hisah wrote:QW25081985 wrote:the deal wrote:That disconnection between the Shilling rally and the NSE rings alarm bells considering the stock market moves ahead of events. DIVERGANCE !!!!!!!!!!!!!!!!!!!!!!! something of the two has to catch up ..i have also noted the disconnect. am thinking stocks should be rallying but yet again we have too much risk ahead . but i hoe the shilling at 85 will lend the stock market some support KES rally is based on USD IMF support and not fundamentals of the squeaking econ. Thats the stocks slump vs KES rally disconnect. And KES is a horrible liar. I've also pointed out the inverted yield curve scenario in the money market in another thread. Read about inverted yield curve outcomes. well i know divergence leads to VERY strong ( and i mean VERY strong moves)i have seen it all the time in forex and the stock market is no exception. This DIVERGENCE has to correct in due time and i believe that means stocks rallying hard ....guys keep that in mind !

|

|

|

Rank: Elder Joined: 9/29/2006 Posts: 2,570

|

hisah wrote:jerry wrote:@hisah, What is the effect of O6? this is the week we expect confirmation ama? Just a reminder and not related to the curves. @jerry - I don't get your query? Ocampo 6 and the market reaction! The opposite of courage is not cowardice, it's conformity.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

jerry wrote:hisah wrote:jerry wrote:@hisah, What is the effect of O6? this is the week we expect confirmation ama? Just a reminder and not related to the curves. @jerry - I don't get your query? Ocampo 6 and the market reaction! I think the market has priced that effect. What is yet to be priced in is the econ slowdown hangover. $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@Qw - The divergence calls for stocks to bounce on the fake KES strength. But the next round of selling when the econ data starts looking pretty ugly will lead to an interesting selling bout. Manufacturing sector will have trimmed earnings more than expected as well as banks. This really is yet to be priced in. An inverted yield curve is always a leading indicator. Until this flips over a recession is on the cards. During recessions you have rallies - bear rallies and they'll be plenty. But since 2008 GFC I never underestimate the CBs printing madness resolve to kill off a recession immediately!? If you look at euroland & US stock markets lofty values, clearly the econ situation doesnt matter!? So NSE faces a KES disconnect and a global stocks disconnect. Two divergence scenarios that tell an interesting story... $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

hisah wrote:QW25081985 wrote: what kind of charts is that ?? give us candlestick charts , bwana @qw - must it be a candle stick chart... The pattern is the pattern... candle stick chart za nse zapatikana wapi. Nelly data hawana

|

|

|

Rank: User Joined: 8/29/2011 Posts: 1,045 Location: Mtaani

|

mwekez@ji wrote:hisah wrote:QW25081985 wrote: what kind of charts is that ?? give us candlestick charts , bwana @qw - must it be a candle stick chart... The pattern is the pattern... candle stick chart za nse zapatikana wapi. Nelly data hawana if you have mystocks live they do have candlesticks charts even the cheapest subscription . @ hisah . come on man . lol....candlestick charts convey a WHOLE lot of info. i rarely use line chart.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

guru267 wrote:hisah wrote:Equity - likely to test 16/- If this support breaks the acceleration down will be swift all the way to 12/-

KCB - very ugly chart. More downside coming aiming 11 - 12/- I think you are over estimating the bears on these stocks.. But I do agree we need volumes otherwise prices can drop irrationally.. at 14 & below the support from fundamentalists will be overwhelming on both counters so I do not support your vision of 12bob.. To say that is to assume there are no fundamentals present on the NSE... 1-0 to @guru  - Lakini hizo volumes are very thin to offer solid support. - Lakini hizo volumes are very thin to offer solid support.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

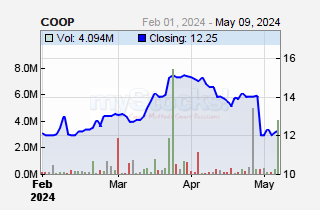

This cartoon (chart), I like coz of volume spread below 12/- Grabbed some today for a traders play. Target 15/-  Also scoping this chart after sellside target has been hit @7.50. A double bottom (support) most likely to form around 6.50.  $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

@hisah, what will drive coop to 15? It underperformed in Q3 and is likely to underperform at Full year. EPS could be at 1.7 and DPS at 0.8 (On the higher side). And then they start talking of rights issue

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

mwekez@ji wrote:@hisah, what will drive coop to 15? It underperformed in Q3 and is likely to underperform at Full year. EPS could be at 1.7 and DPS at 0.8 (On the higher side). And then they start talking of rights issue I'm looking at the volume spread and 11.70 is being defended.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

hisah wrote:mwekez@ji wrote:@hisah, what will drive coop to 15? It underperformed in Q3 and is likely to underperform at Full year. EPS could be at 1.7 and DPS at 0.8 (On the higher side). And then they start talking of rights issue I'm looking at the volume spread and 11.70 is being defended. True, but 15 is a long shot. What informs that target?

|

|

|

Rank: Elder Joined: 1/21/2010 Posts: 6,675 Location: Nairobi

|

mwekez@ji wrote:@hisah,

True, but 15 is a long shot. What informs that target? Dont you know... its the CHARTS speaking here  Mark 12:29

Deuteronomy 4:16

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

mwekez@ji wrote:hisah wrote:mwekez@ji wrote:@hisah, what will drive coop to 15? It underperformed in Q3 and is likely to underperform at Full year. EPS could be at 1.7 and DPS at 0.8 (On the higher side). And then they start talking of rights issue I'm looking at the volume spread and 11.70 is being defended. True, but 15 is a long shot. What informs that target? Using fibonacci forecast on assumption that 11.70 is a floor for now. Yep, doesn't make sense fundamentally! But someone or something is interested at those lows per volume spike. SCB rights come to mind when it rallied to 300. This is a risky trade going against the tea leaves. But those volume spikes say a lot.$15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

hisah wrote:mwekez@ji wrote:hisah wrote:mwekez@ji wrote:@hisah, what will drive coop to 15? It underperformed in Q3 and is likely to underperform at Full year. EPS could be at 1.7 and DPS at 0.8 (On the higher side). And then they start talking of rights issue I'm looking at the volume spread and 11.70 is being defended. True, but 15 is a long shot. What informs that target? Using fibonacci forecast on assumption that 11.70 is a floor for now. Yep, doesn't make sense fundamentally! But someone or something is interested at those lows per volume spike. SCB rights come to mind when it rallied to 300. This is a risky trade going against the tea leaves. But those volume spikes say a lot. K. Al z best

|

|

|

Rank: Chief Joined: 5/31/2011 Posts: 5,121

|

Interesting show by Coop as at 2pm

Foreign sales 14.6M

Foreign buys 2M

Total turnover – 47M

VWAP: 13.00

Good picking by locals as foreigners leave. Similar scenario @ Equity Bank counter.

|

|

|

Rank: Chief Joined: 8/4/2010 Posts: 8,977

|

@mwekez@ji - the foreign sellside behaviour is very interesting on NSE for a while now since H2 2011. Keep an eye on euroland, the party is getting interesting... The Greek 1yr bond yield closed at 1006% making the KE Tbills/bonds yields look like peanuts!? $15/barrel oil... The commodities lehman moment arrives as well as Sovereign debt volcano!

|

|

|

Wazua

»

Investor

»

Stocks

»

Stock traders Corner.

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.

|